Look at each time the S&P 500 Index fell by 8% since 1928, and you will find two very different types of outcomes. 85% of the time, an 8% drop resulted in only a shallow correction, an average of 13%, which the market recovered from, on average, in just 106 days. That’s tolerable.

However, in 15% of the 8% drops, the stock market was headed into a severe Bear Market, suffering an average decline of 43%, which took 1090 days to recover.* That’s three years – from the bottom – just to get back to even. Anyone who invested through the Tech Bubble in 2000-2001 and the Crash of 2008-2009 needs no reminder that Bear markets have always been a part of investing.

Given a choice, wouldn’t you rather be on the sidelines when things are falling apart? Investors of all ages feel this way, but for those who are closer to retirement, we don’t have the luxury of saying, “Well, I can just Dollar Cost Average since I don’t need to touch this money for 30 years”.

Most sources say you cannot time the market. That’s because people usually base their decisions on sentiment and worthless forecasts. We are blind to our own confirmation bias, where we look for opinions that support our prejudices, rather than looking objectively at all evidence.

Without a crystal ball, how can you tell when a small drop is just a brief correction versus the first weeks of a longer Bear Market?

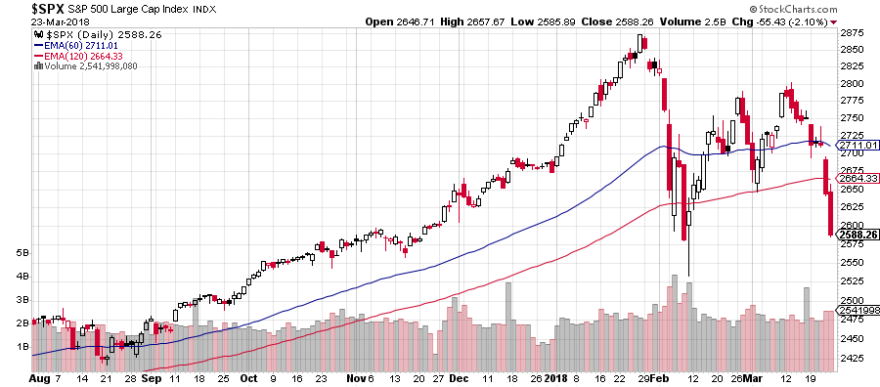

To remove human emotion and look solely at the price movement of the market is the objective of Technical Analysis. Let’s consider a chart of the historical prices of the S&P 500 Index. One of the ways to examine the larger trend of market is through a Moving Average (MA). This is simply a measure of the average price over a number of days, such as 20, 60, 120, or 200 days. A Moving Average with small number of days responds quickly to changes in market prices, whereas a MA based on a large number of days is smoother and slower to react.

When the market is boldly moving up (like in 2017), a chart will have these characteristics:

- The 60-day moving average is above the 120-day moving average, and both have an upwards slope, gaining each day.

- The current price of the market is above the moving averages, pulling the averages higher.

When we are in a prolonged decline (like in 2008), a chart will typically have the reverse characteristics:

- The 60-day moving average is below the 120-day moving average, and both have a downwards slope, sinking each day.

- The current price of the market is below the moving averages, pulling the averages lower.

A brief drop, like we experienced in February, is a temporary blip in the market price and has little impact on the longer 60 or 120 day moving averages. Technical Analysis suggests that a Bear Market may be starting when there is a crossover – when the 60-day MA goes from being above the 120-day MA to being below it.

Crossovers are considered a major shift in the direction of the market, and often do not occur for years at a time. Crossovers occurred relatively early in the previous two Bear Markets and if you had used that signal to sell, you would have significantly reduced your losses. The reverse crossover, when the 60-day breaks above the 120-day MA, is considered a Bullish indicator that the downwards trend has broken. That’s the Buy signal to get back into the market.

A few caveats are in order: these signals will not pinpoint the top or bottom of the market. With a 60-day lag, the market could have already have suffered significant losses before we get a “Sell” signal. Similarly, at the bottom, the market could have rebounded by a substantial percentage before we get the “Buy” signal to get back in. In a shorter Bear Market, these indicators might have you get out at a loss and then buy back in at a higher level, adding insult to injury.

Looking at back-tested funds which use this approach, however, they would have had lower losses in the past two Bear Markets. While it’s nice to avoid the losses, what is even more compelling is how well the strategy performs over 10 or more years. After studying this for nearly two years, we are now going to offer this strategy to our clients, calling it the Equity Circuit Breaker.

This does not change what we purchase in our portfolios. Investors will have the choice of adding the Equity Circuit Breaker or not. If you want to participate, we will track these moving averages and when a crossover occurs, we will sell your equity positions and move the proceeds into cash or short-term Treasuries. When the Bullish crossover occurs, we will buy back into your equity funds, returning to your target asset allocation.

The goal is to reduce losses then next time we have a Bear Market. While there is no guarantee this program will work exactly as it has in the past, you might prefer to have a defensive strategy in place versus the alternative of staying invested for the whole ride down and back up.

I am making this optional for two reasons. First, some investors have a long enough time frame to accept market volatility and prefer a simpler approach. Second, taxes. Selling your equity positions in a taxable account could generate capital gains.

But let’s take a closer look at the tax question. Let’s say you have a 50% gain in your equity positions. You started at $200,000 and it has grown to $300,000. If we were to sell those positions and create $100,000 in long-term capital gains, you’d be looking at 15% tax, or $15,000. (Long-Term Capital Gains could be as high as 23.8% for those in the top tax bracket.) That is a substantial amount of tax, but could still be worth it. If we avoid a 20% drop, you would have prevented $60,000 of losses.

Paying some taxes along the way also will increase your cost basis and basically just pre-pay taxes you would otherwise pay later. For example, Investor A buys a fund for $10,000, sells it at $15,000 after year two and generates a $5,000 capital gain. Then she buys back into the fund with the $15,000 and sells it at $18,000 at year five, for a $3,000 gain. Investor B buys a fund for $10,000, holds it for the same five years, and then sells for $18,000. Both investors will pay the same tax on $8,000 in capital gains. Investor A just split that tax into two segments whereas Investor B paid the tax all at the end.

Of course, if your accounts are IRAs, we could trade without any tax consequences. If you’d like to add the Equity Circuit Breaker to your Good Life Wealth Management Portfolio, there is no additional cost, just reply to this email. We also offer the option of limiting the Equity Circuit Breaker to your IRAs and not to your taxable accounts. I’ll be talking with clients individually throughout the Spring about the new program.

As of today, we have not had a crossover, so there is not yet a trigger for us to sell. I will be looking at this on a regular basis. Investors should make the decision about participating well in advance of the trigger occurring. Once the losses have already started, it is harder to make a decision. I think the best use of this approach is passive – to consider it carefully in advance, turn it on (or not), and then leave it alone. We will do the work for you.

If today’s market is making you nervous, the Equity Circuit Breaker may help you sleep better at night. You have been telling us “we want to participate in the upside, but want to step aside when things get ugly.” If that’s what you’ve been thinking, feeling, or wishing, we can provide you with a plan that’s based on a disciplined process.

*Market Pulse, Goldman Sachs Asset Management, February 2018

2 Comments

Comments are closed.