It’s summer break and your little grandchildren are one year closer to college. Still haven’t set aside any funds for their college expenses? For grandparents who have the means to help with future college expenses, the 529 College Savings Plan is a tremendous tool. Here are the Top 10 questions grandparents ask about 529 plans.

1) What are the tax benefits of 529 Plans?

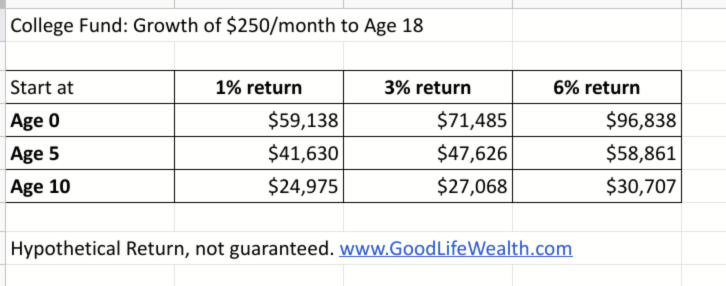

Many states offer a state income tax deduction for contributions to a 529 plan. There are no federal tax deductions for 529 contributions, however, withdrawals for qualified higher educational expenses are tax free, so any future gains would be tax-free. The earlier you establish a 529, the greater potential growth you may have in the account. And the greater the potential tax savings!

2) Which 529 plan should I choose?

The first step in choosing a 529 College Savings Plan is to determine if there is any benefit or incentive to using the “in-state” plan. For example, if you are a New York resident, you can deduct up to $5,000 off your NY state income tax return if you participate in the New York 529 plan. For married couples, you can deduct up to $10,000 per year. The NY deduction is per tax-payer, not per beneficiary. However, in other states, the tax deduction may be per beneficiary and may even carry forward to future years.

In states without an Income Tax, such as Texas and Florida, there are no tax benefits or credits for using the in-state plan, so you can choose from any plan in the country. You might choose a plan with very low costs and a good selection of investments. The rules vary by state, so you will want to look up this information on www.savingforcollege.com.

3) What expenses can you use a 529 Plan for?

529 plan distributions for Qualified higher educational expenses are tax-free. These qualified expenses include tuition, fees, books, lab supplies, computers, and room and board. If your student lives off campus, you are limited to the same amount of expenses that they would have had for living on-campus. You cannot take a qualified 529 Plan distribution for transportation, student loan costs, health insurance, sports/clubs, or other expenses.

4) Are there limits to 529 contributions?

Contributions to a 529 Plan are considered a gift by the IRS and are subject to gift tax rules. For 2023, the annual gift tax exclusion is $17,000 per beneficiary. However, 529 Plans have a special exception to this rule which allows you to fund five years of contributions in one year, or $85,000 per beneficiary ($170,000 per beneficiary if funded by a married couple).

Most parents and grandparents try to keep 529 contributions within the Gift Tax exclusion amounts. However, you can contribute more than this amount if you want. But, you will have to file a gift tax return and use up a portion of your unified lifetime exemption.

5) How do assets in a 529 plan impact my estate planning and eligibility for Medicaid?

Assets in a 529 plan are excluded from your taxable estate. If you are likely to be subject to the estate tax, 529 plans are a terrific tool to shelter assets from the estate tax while maintaining control of those funds. If you have funded five years in advance, and do not survive the five years, the donor’s estate will have to add back a pro-rata portion of the 529 contribution to the taxable estate.

Medicaid rules vary by state. 529s may be counted as assets in some states and may be subject to “look back” provisions by Medicaid. If you are thinking you will become so impoverished to qualify for Medicaid (not Medicare), you might not be the best candidate to be giving money to a 529 Plan.

6) How do 529 plans affect students’ eligibility for financial aid?

Grandparents’ assets are not disclosed on the Federal financial aid application (the FAFSA), so student financial aid eligibility is actually improved compared to having those same funds held in either the parents’ or student’s name. Taking a distribution, however, from the 529 plan is considered reportable income on the FAFSA, so the best time to use the grandparents’ 529 is in the student’s final year of college. The CSS has different rules, so you also have to know which process your university will use for determining financial aid.

7) What if my student doesn’t need the 529 Plan?

If your student doesn’t use the full 529 plan, you have a lot of options. Thankfully, there is no expiration date or time restriction on a 529 account. You can change the beneficiary to another relative, or even save it for future grandchildren. Your beneficiary can also use $10,000 (lifetime) from the 529 to repay student loans. These options all retain the full tax benefits of the 529 Plan.

There are several exceptions to the 10% Penalty. This means you could take a withdrawal, and the gains would be taxable income, but the 10% Penalty would be waived. These situations include: receiving a scholarship, attending a US Military Academy, or the disability or death of the beneficiary.

8) Can 529 plans be used to help pay for private high schools?

Yes, after the Tax Cuts and Jobs Act (TCJA) 529 plans were expanded to be usable for private elementary and high school tuition. This is limited to $10,000 per year. But be careful, a handful of states will consider this use a taxable distribution (including CA, CO, HI, IL, MI, MN, MT, NE, NY, OR, and VT).

9) What if I end up needing the money in a 529 plan for my own expenses?

Since you control the assets in a 529 Plan, you can make a withdrawal at any time. A 529 plan is revocable by the owner. However, if the withdrawal is taken for a reason other than a qualified higher educational expense, any gains would be subject to income tax and a 10% penalty. Note that the tax and penalty apply only to the gains, not to your principal. If you have multiple 529 accounts, select the one with the lowest gains if you need a withdrawal, and then you can change the beneficiaries on the remaining accounts as needed. Otherwise, all non-qualified distributions are considered a pro-rata distribution consisting of both principal and earnings (like an IRA, there is no FIFO or principal first rules).

10) When does it make sense to pay for college tuition directly or give the money to my child or grandchild to pay for tuition instead of opening a 529 plan?

If a student is within a year or two of college, you may not see sufficient growth in a 529 account to receive much of any tax benefit. 529s are much more attractive when funded at an early age to allow for many years of growth.

While 529 contributions are subject to the gift tax rules, those limitations do not apply to payments made directly for education or medical expenses. If the expenses are greater than the gift tax exclusion amounts, it may make sense to pay college expenses directly, rather than choosing to file a gift tax return and use up part of your lifetime unified exemption. Money given directly to your children or grandchildren will be reported on the FAFSA, which could increase their expected family contribution and potentially reduce their eligibility for other sources of financial aid. It would be preferable to pay the college tuition bill directly rather than giving money to your children or grandchildren.

If you have questions on 529s or college planning, feel free to drop me an email. I am here to help.