We are in Paris and several clients have reached out to make sure we are doing okay, given the demonstrations and riots regarding France’s retirement system. Yes, we are fine and actually never saw any of these events other than on the news. Day to day life in Paris is normal, and thankfully the garbage strike is over. It has been perfectly tranquil in our neighborhood and we are enjoying life in the city.

Why are the French upset? Currently, if you are 62 and have worked for 42 years, a French citizen can receive their full retirement benefit of 50% of the average salary of their highest paid 20 years of work. If you don’t have 42 years of contributions, you will receive less than 50%, or you can work for longer to increase your benefit up to 50%. So, if you had been making $60,000 (Euros actually), you could potentially retire at 62 with a $30,000 pension. Under the new rules, the full retirement benefit will not become available until age 64 with 43 years of work. There are some interesting parallels between US and French Social Security.

The French Connection

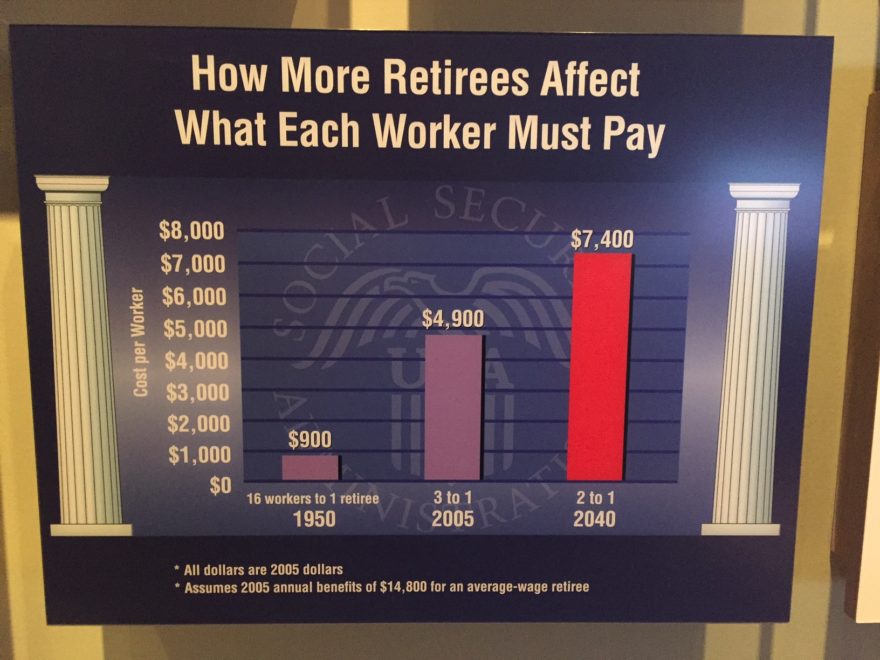

In a recent interview, France’s President Macron defended the changes, which have been enormously unpopular. Macron explained that the program has always been an entitlement program, where current benefits are paid by current taxes. It is not a personal savings or investment account. When Macron took office, there were 10 million retirees receiving benefits, out of France’s 67 million population. Today, there are 17 million retirees and that number will grow to 20 million by 2030. 20 million pensioners out of a total of 67 million people. There are 1.7 workers in France for each retiree.

1.7 workers cannot provide an average monthly benefit of 1300 Euros for each retiree. There are only two options, increase taxes or decrease benefits. France already has high taxes, 20% just for social programs (this also includes health insurance, unemployment, maternity benefits, and other programs). 14% of France’s GDP is just retirement pensions. France compared their program and expenditures to similar countries and recognized that their retirement age was too low, given how much longer people are living today.

Macron tried to work with representatives in their Parliament on a solution. But when no agreement could be reached, he issued an executive order to make the changes without a vote. He noted that he had to do what was in the country’s best interest in the long term and preserve the program for their children and grandchildren, even if it was not the most popular thing to do. I was impressed by his directness, intelligent explanation of a complex problem, and courage to do the right thing even when it is not easy or popular.

The US Conundrum

I’ve been writing about the problems facing US Social Security since 2008. Back then, the 2036 projected collapse of the Social Security Trust Fund seemed like a lifetime away. Today, Social Security projects that the Trust Fund will be depleted by 2033. At that time, taxes will only cover about 70% of promised benefits. And every year, the Social Security Trustees report tells us how much we need to increase taxes or decrease benefits to keep the program solvent for 75 years.

Unfortunately, over the last 15 years no changes have occurred. It has been political suicide for any politician to suggest reforming Social Security. The easiest attack ad has always been to say that your opponent wants to “take away your Social Security check”. So we keep on marching towards that cliff with no change in direction. Shame on our politicians for not being willing to save the foundation of our retirement.

When Social Security started, there were 16 workers for every retiree and the average life expectancy was 65. Today, there are 2.8 workers for every retiree and that ratio continues to shrink. The typical 65 year old, in 2023, will live for at least 20 years. Like in France, it doesn’t matter what “you paid into Social Security”. That’s not how the program ever worked. Current taxes pay current beneficiaries. Your past contributions were spent on your parent’s or grandparent’s check.

No Easy Solution

Compared to France, the US demographics may look better. However, France actually is running a smaller deficit on their retirement program – only a 10 Billion Euro average annual shortfall for the next decade. They actually ran a surplus in 2022 and are proactively making these changes looking forward to the decade ahead. They’re making changes before there is a deficit! (Social Security spent only $56 Billion of the Trust Fund last year, but this will accelerate and deplete the whole $2.8 Trillion over the next 10 years.)

For the US, if we we wait, it will magnify the size of the changes needed. It would be better to start today to save Social Security. We can either increase taxes or reduce benefits. Those are the only two options. No one wants to do either, so we have to reach a compromise.

Thankfully, there are actuaries at Social Security who study all proposals. Their annual report estimates how much of the shortfall could be reduced for each change. Here are some of their calculations, looking at the improvement of the long-range actuarial balance. (We should be looking for some combination which equals at least 100%.)

Impact of Possible Changes to US Social Security

- Reduce COLAs by 1% annually: 56%

- Change COLA to chained CPI-W: 18%

- Calculate new benefits using inflation rather than SSA Average Wage Index: 80%

- Reduce benefits for new retirees by 5% starting 2023: 18%

- Wage test. Reduce SS benefits from 0-50% if income is $60k-180k single/$120k-360k married: 15%

- Increase Full Retirement Age from 67 to 69 by 2034, and then increase FRA by 1 month every 2 years going forward: 38%

- Increase the Payroll Tax from 12.4% to 16% in 2023: 103%

- Eliminate SS cap and tax all wages: 58%

- Eliminate SS cap, tax all wages, but do not increase benefits above the current law maximum: 75%

- New 6.2% tax on investment income, for single $200k / married $250k: 29%

I don’t have an answer for what Washington will do. But we can look at what will actually work. And what is perhaps even more interesting is what doesn’t work. It is shocking, for example, that wage testing SS only improves the shortfall by 18%. Or that Reducing COLAs by 1% every year only will cover half the shortfall. Unfortunately, we may need to increase taxes. Moving to 16% payroll tax would fully cover the shortfall. That would be a relatively small increase from 6.2% to 8%, each, for an employee and the employer. But that is a regressive tax, which would impact low earners more than high earners. For reforms to work, it might require a combination of both increased taxes and reductions in the way benefits increase.

Kicking The Can Down The Road

Will the US take action to save Social Security, or will the reaction in France scare US Politicians? It’s hard to imagine our divided Congress reaching a compromise on an issue as difficult and controversial as changing Social Security. But any politician who is still talking about the other side as “trying to take away your Social Security” is now part of the problem and not part of the solution. Kicking the can down the road is not going to help America.

What is certain is the need to save Social Security. It is the largest source of retirement income for most Americans. And the lower your income, the more Social Security is needed to cover retirement expenses. We can’t keep ignoring the future of Social Security, it’s not going to get better on its own. The status quo is not an option.

I hope the US won’t see the same riots as Paris. But I also hope US politicians will do their job and have the courage to make the tough choices that are in the best interest of the public. US and French Social Security are both in the same precarious state. Let’s hope Winston Churchill was right: “You can always count on Americans to do the right thing, after they have exhausted all other possibilities.” That day is coming soon.