Twice a year, Standard and Poors updates their comparison of Index Funds vs Mutual Funds, called SPIVA (S&P Index versus Active report). I have written about SPIVA a number of times, and it is worth repeating, because the data is remarkably consistent.

The majority of actively managed funds do worse than a benchmark or index. The newest report was published today, covering all US Funds through June 30, 2023. When we look at long-term returns, here are the percentage of active mutual funds that performed worse than their benchmark:

| Category | 5-yr | 10-yr | 15-yr | 20-yr |

| All Domestic Stock Funds | 89.08% | 90.19% | 93.15% | 93.12% |

| International Stock | 81.84% | 84.78% | 85.33% | 92.50% |

| Emerging Markets | 70.70% | 87.56% | 89.58% | 92.42% |

The evidence comparing index funds versus mutual funds is clear: Index funds are the hands down winner. While past performance is no guarantee of future results, there continues to be overwhelming evidence that index funds do better than the vast majority of active funds over the long-term. And this finding is remarkably consistent, regardless of whether we are in a Bull or Bear market.

Equal Weight Index

2023 has been a strange year in the market, with narrow breadth of performance. Looking at the S&P 500, performance has been concentrated in a small handful of names, with five large stocks up more than 100% in the first half of the year. So for strategies which didn’t own these high flyers, it was tough to keep up. Value, Small Cap, and other strategies have lagged the Large Caps this year.

But that is likely to reverse, as it has been quite extreme. I’ve written previously about Equal Weight funds, specifically the S&P 500 Equal Weight. It owns the same 500 or so stocks as the S&P 500, but in equal proportion. The standard S&P 500 which weights each stock on its size (“market capitalization”).

Over the very long-term, the Equal Weight strategy (EW) has outperformed. From 1991 through 6/30/2023, the EW S&P 500 index has a return of 11.82% a year, versus 10.55% for the regular S&P 500. That is a noteworthy, long-term improvement in performance, and is typically attributed to the idea that EW has less of the “over-valued” stocks and more of the “under-valued” stocks.

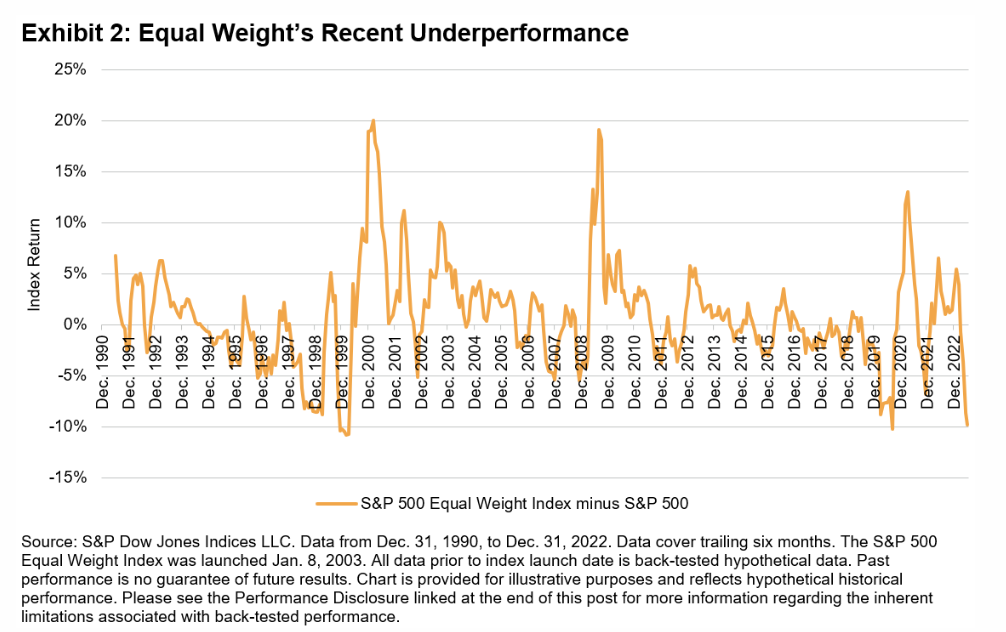

While EW has outperformed over 30+ years, it has not done so consistently or every year. But what is interesting is that when EW has underperformed to an extreme level, it has historically snapped back. And that is where we are today: EW lagged by 9.9% for the first half of 2023. In the chart below from S&P, previous 6-month periods of EW underperformance were followed by periods of strong EW outperformance. The returns have been mean reverting, with EW providing long-term returns in excess of the cap-weighted index

Mean Reversion Ahead?

This would suggest that the outperformance by the Mega-Cap names of the S&P 500 is unlikely to continue. We own some Value and Mid Cap funds which have not kept up with the S&P 500 this year. That can be frustrating and make investors want to pile into those high flying stocks. But the reality is that the outperformance of the biggest stocks versus EW may be overdone. In fact, it is in the 2nd percentile for the first half of the year, more extreme than 98% of previous 6-month periods. Generally, I believe mean reversion is more likely than an extreme trend continuing indefinitely.

We diversify our portfolios broadly and tilt towards areas of better relative value. This has us owning Value funds, multi-factor strategies, small and mid-cap, and Emerging Markets. Why? Our belief in the two topics we discussed today:

- Passive, index strategies are better than active management over the long-term

- We count on mean reversion rather than performance chasing

Both of these approaches are well-grounded in research, but require patience and discipline to stay the course. That’s where we are today. And the data reminds us that this still makes sense. The question of Index funds vs mutual funds is just the beginning. There will be ups and downs, which no one can predict or time, so our focus is on having a good investment process and understanding the fundamentals.