A bubble is brewing. The price of US Tech stocks has grown much faster than their earnings, fueled by the hype of AI transforming productivity and life as we know it. The comparison with 1999 is uncanny, but it’s not that investors have forgotten about the Tech Bubble. I think many are just hoping to make additional gains while momentum is leading these stocks higher.

We are going to look at valuations to put current prices in perspective. Today’s tech stocks have massive profits, unlike the cash-burning dot-com’s that went bankrupt in 2000. It’s great that these tech companies are doing so well, but that doesn’t mean that the price of their stock can never be too high. While the prices have not yet reached absurd levels, they are elevated enough to raise concerns about their sustainability.

Too Big?

Just how big have tech stocks gotten? The three largest stocks in the world are Nvidia, Apple, and Microsoft, all recently with values over $3 trillion, each. Let’s compare these three stocks to countries. Nvidia is worth more than all the stocks in Germany. All 489 German companies put together are worth less than Nvidia. Apple is worth more than all the stocks in the UK. Microsoft is worth more than all the stocks in France. Is each of these companies really worth more than the entire stock market of a major European economy? Apparently the market thinks so, but it is a remarkable disparity.

Nvidia added $1 trillion in market cap, going from $2 trillion to $3 trillion, in just 30 days. Compare this to Warren Buffet at Berkshire Hathaway. He is considered by many to be the greatest investor ever, and it took him 60 years to grow his company to a value of $875 billion. Nvidia grew that much in value in 30 days. Did they do something in 30 days that is worth more than the company Warren Buffet has built over 60 years? We will have to wait and see, but I’m a skeptic.

Value Matters

Today, Nvidia is trading for a Price/Earnings ratio of 65 times earnings, and 43 times the expected earnings of the year ahead. That is double the PE of the S&P 500 Index at 22 times earnings. And today’s S&P 500 is in the top 10% most expensive, historically. These companies will have to really maintain investor excitement, if the stocks are priced at double the market PE. The growth of these tech stocks has come from expanding the multiple – the P part of the PE ratio. The earnings, the E part of the PE ratio, needs to catch up. That could take years. I pick on Nvidia, but the story is similar for Microsoft, Meta, Amazon, Apple, Alphabet, and Tesla. All these are richly valued even though they are incredibly profitable.

After the 2000 tech bubble, many of the survivors took a decade to get back to their value at the peak. You may recall, this was called “the lost decade” in the stock market. I certainly hope this doesn’t happen again. But, today’s most expensive stocks could risk having disappointing returns for years to come. In the past, a PE of 23 often was a bull market peak valuation.

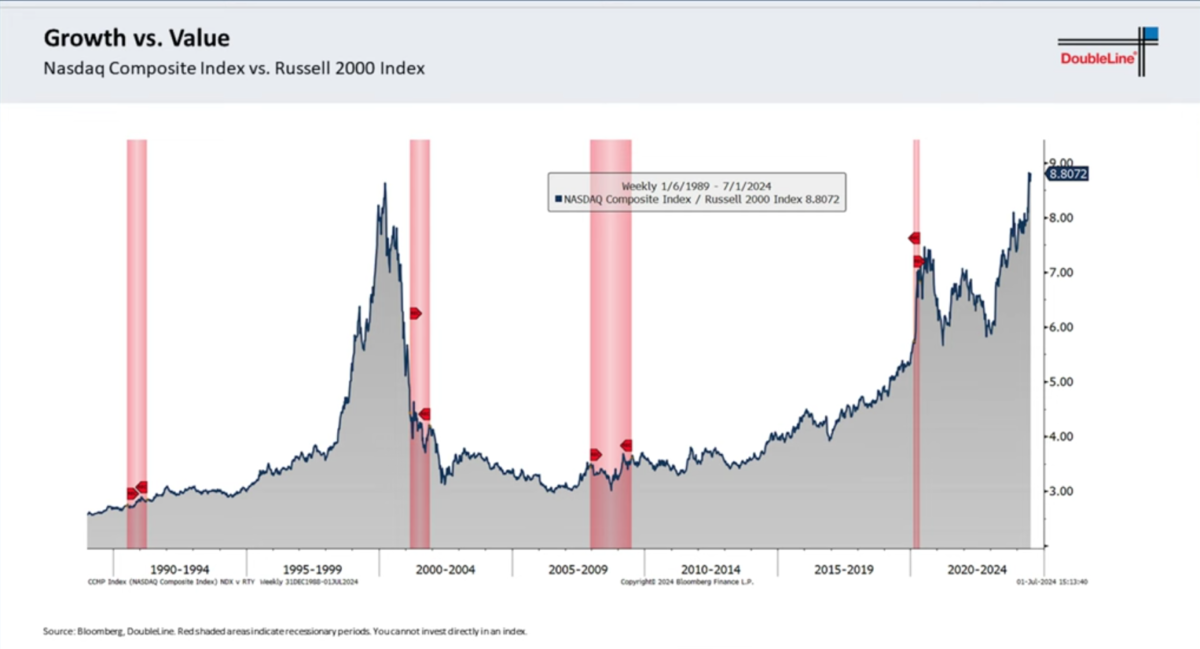

There are other categories which are not as overvalued as Tech. Consider the comparison of Growth Stocks (NASDAQ) versus Value Stocks (Small Cap Russell 2000), with this chart from DoubleLine. Today, the growth/value divide has actually exceeded the levels of 1999. To me this suggests there could be a reversion to the mean in the next couple of years, where growth lags and value finally does well.

Looking Ahead

Investors spend too much time looking at the rear view mirror rather than forward through the windshield. Past performance is not indicative of future returns. And when a bubble occurs, it can take years to deflate. The stocks with the best past returns can do poorly, while the stocks with the worst recent returns may do better going forward. Consider the projected annual returns, for the next 10 years, from the Vanguard Capital Markets Model:

- US Growth Stocks: 0.4% – 2.4%

- US Value Stocks: 4.1% – 6.1%

- US Small Cap: 4.3% – 6.3%

- Foreign Developed Stocks: 6.7% – 8.7%

- Emerging Markets: 6.0% – 8.0%

According to their calculation, you would be better off buying a 10-year US Treasury Bond (at 4.25% today), rather than owning US growth stocks over the next decade. Investors have been enjoying Tech growing at 20% a year, and now we are looking at an expected return of 1.4%. This is why we own value stocks, small cap, foreign stocks, and emerging markets in our portfolios. We are looking forward, not backward at past returns, when creating our models. We are diversifying into what we believe might be tomorrow’s winners rather than looking to concentrate into what has worked most recently.

Evidence Based Investing

We will see if today’s tech stocks have become an unsustainable bubble. These are really good companies which have enormous profits and are still growing at attractive rates. Even if there is not an abrupt bursting of the tech bubble, it is possible that growth segments will under-perform other categories over the years ahead. There is a strong rationale to be cautious about investing in stocks which have become very expensive.

Over the next month or year, growth stocks could continue to go up. Still, tech stocks could prove to be in a bubble which we see correct later. There might be an outside catalyst (think COVID, geopolitical event, debt crisis, recession, or something which no one had even considered), which causes a drop in the market. If this occurs, the most expensive stocks often sell off the most.

Tech stocks have become very large, quite expensive, and have a lower expected return than other stocks and many bonds. Our diversification allows us to both play defense today and also to own the categories with the highest expected return going forward. Don’t give up on Diversification!