It’s January 1st and we are looking at our Investment Themes for 2025. We adjust our portfolio models annually, looking to take advantage of the latest information. Using an evidence-based evaluation of the available investment universe, we weight our portfolios towards the categories with attractive long-term return expectations. We don’t time the market – we are buy and hold investors and stay fully invested in a target allocation. Market downturns are an inevitable part of being an investor and we think it is detrimental to try to predict short-term movements. We know that predictions are highly fallible and that there is a real benefit to staying diversified.

This is our process to tactical asset allocation: we always start with the overall “recipe”. The key choice is deciding the right weight of each category. Then within each category, we use low-cost Exchange Traded Funds. That’s because we know that the majority of active managers do worse than their benchmark. We would rather invest in an Index or Factor based strategy.

You can see our past Investment Themes for 2024, 2023, 2022, and 2021 on our website. Now, here are our thoughts for 2025 on stocks and bonds. In an effort to keep this relatively concise, I am giving you a summary below, and not my full analysis and thoughts on each category. And you also don’t see the analysis that goes into the ETF and fund selection process, but that step is secondary to getting the overall allocation right.

US Stocks Expensive But Have Momentum

We’ve just had two years in a row with greater than 20% returns in the S&P 500 Index. US Stocks have gotten more expensive, however, this has largely been a story of a handful of tech stocks driving the returns of the whole market. The market has had poor breadth – the majority of stocks have barely moved at all in the last two years. Much like 1999, we may eventually see a period of poor performance in the overall index, where today’s winners lose their steam. And it is also possible that the 493 stocks which are not the “Magnificent 7” could do better in the years ahead.

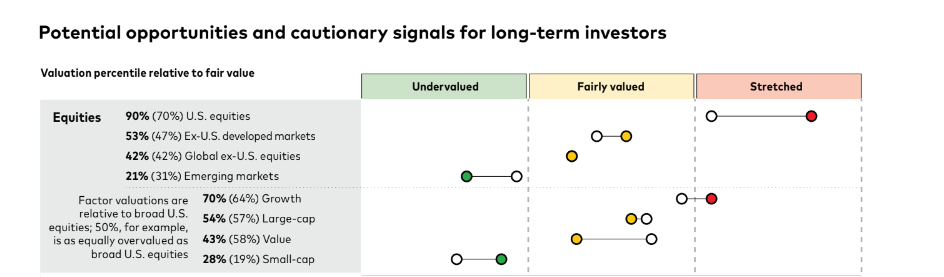

The Vanguard Capital Markets Model and research from Goldman Sachs both suggest that the S&P 500 is likely to have returns in the low single digits over the next decade. This is why we have been overweight in Small Cap and International stocks. However, we were too early in 2024 and US Large cap stocks have continued higher in spite of being more expensive than other stocks.

We will be adding to US Large Cap for 2025, reducing our underweight in the category. We will make this purchases by trimming bonds and bringing bonds down to neutral. The momentum in US Stocks is strong right now and we have decided we want to more closely track the market for the time being. For clients who would prefer a larger allocation to bonds, we can switch models, for example from 70/30 to 60/40. I do think we will want more international equities eventually. But until we see signs of a reversal, US Stocks are leading the world.

Equity Notes:

- Better long-term expectations from international versus US; from value versus growth; from Small Cap versus Large Cap. We will maintain our broad diversification.

- Going into 2025, US Large Cap has been strong and we want to add to that momentum for now.

- We prefer equal weight index versus market cap weighted index. We are adding to US Equal Weight Index from bonds.

Bonds and Fixed Income

The Fed has started to cut interest rates and the yield curve has flattened. We have seen the short end of the yield curve coming down and we seem to be out of the inverted yield curve. For several decades, an inverted yield curve always preceded a recession within 12 months on average. Will we escape this recession signal in 2025? At least as of right now, December 2024, there are no signs of a US recession on the horizon.

But the interest rates dropping has given us a wave of bond calls. Our Agency Bonds which were yielding 5.5% to over 6% are all getting called early. We have seen yields as low as 4.8% getting called this month. That means having to replace those bonds with lower yields, presently 4% to 5.25%. That is a bit disappointing, especially if these bonds could potentially be called in another 6-12 months. Agencies, Corporations, and other issuers will continue to refinance at lower rates. Unfortunately, there are not a lot of non-callable bonds, with competitive yields. We will continue to Ladder bonds from 1-5 years, and we principally use Treasuries under 2 years and Agency Bonds from 2-5 years.

MYGA fixed annuities remain a great tool for guaranteed monthly income for retirees. Any investor seeking to lock in today’s interest rates, without the possibility of a call, will like a MYGA. I personally bought another MYGA in 2024 for my Roth IRA and these remain very attractive going into 2025.

Notes for Bonds in 2025

- We reduced our overweight in bonds to neutral, given ongoing bond calls and falling rates.

- Our focus is on high quality US short-term individual bonds, laddered from 1-5 years.

- The spread on investment grade corporate and municipal bonds is too low. They have more risk than Treasuries and Agency bonds.

- High-yield bonds are yielding over 6%. If you believe the estimates of the S&P 500 returning only 4-5% over the next decade, high yield corporate bonds are a lot less volatile than owning Equities, with a comparable or better return.

- We continue to own Emerging Market bonds. They had a great 2024 and have attractive yields entering 2025. Other international bonds are too low yielding and also very volatile.

- We had considered selling our TIPS (Treasury Inflation Protected Securities) in September when prices were high. However, with the possibility of inflation returning due to proposed tariffs, we are maintaining our allocation to TIPS.

- After a strong rally in 2024, Preferred Stocks seem to have topped out for now. We are reducing allocations from 5% to 3% in most portfolios.

What Not To Do

With the incoming administration in Washington, we will undoubtedly see a number of programs which could impact the economy positively or negatively. We are following these developments closely. The positive impacts for investors could include deregulation, lower income taxes, and lower corporate taxes (stocks are valued on their profits, which are after-tax). On the other hand, we worry about tariffs causing inflation, retaliatory tariffs from other countries hurting US exports, and inflation due to deporting millions of workers. And then there is the massive government debt, which now costs over $1 trillion in interest alone each year. (Last week’s rant – Congress hastening Social Security’s insolvency to 2033, just 8 years away.)

We can’t make light of any of these situations. We are prepared to adjust our portfolios as needed. However, I think that making significant changes to our investment allocations is both unwarranted right now and probably harmful in the long-run. Regardless of who was in the Oval Office, the US stock market has had a great track record of going up and to the right. Profits today are strong and hopes are high for AI-driven growth and productivity. And so there is a risk of putting too much focus short-term political concerns and missing the growth of the US and Global economic engine.

One of the challenges of making our Investment Themes for 2025 was resisting the temptation to make a lot of changes. We can see what is working right now. If you have a good plan and allocation, I don’t think that you need to throw it all away in 2025. No one knows what the market is going to do. Many other investors have the same thoughts or concerns and so these are often already reflected in the price of stocks.

10 years from now, portfolios are likely to be significantly higher than today. We will likely have forgotten all about 2025 entirely, just as we don’t think much about 2015 today. Our Investment Themes for 2025 are important, but our behavior and process are more important than any one particular year in the market. We don’t know what the new year will bring, and that’s okay. We do know what has worked consistently: holding a diversified allocation, using index funds, and keeping costs and taxes low. That is our focus and unwavering commitment to you.