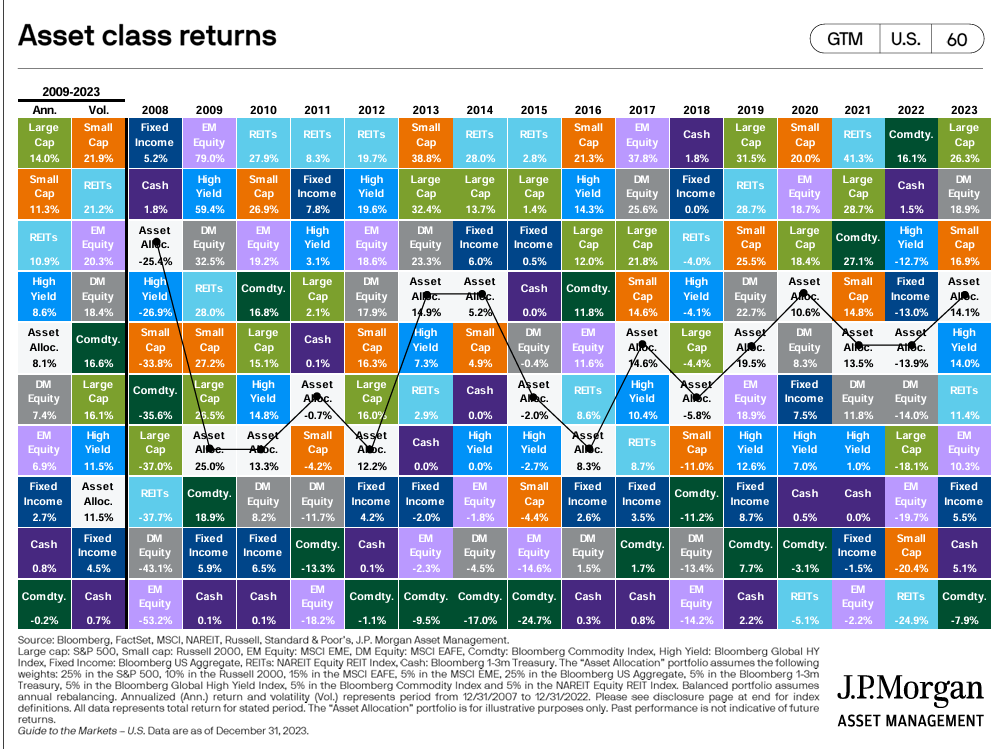

The chart below highlights the perils of performance chasing versus the benefits of diversification. This chart from JP Morgan shows the annual performance of major investment categories from 2008 through 2023. It includes US Stocks (large and small), Developed Markets, Emerging Markets, Fixed Income, Cash, Real Estate, and even Commodities.

The results are all over the place. What is often the best investment in one year turns out to be the worst investment the next year. Consider:

- Commodities were the best category in 2022 and the worst in 2023.

- Real Estate Investment Trusts (REITs) went from worst in 2020 to best in 2021, and back to worst in 2022.

- Cash was the worst investment in 2016 and 2017, then the best in 2018, and back to the worst in 2019. It was however, positive, in each of these years!

- Emerging Markets Stocks were the worst category in 2008 then the best in 2009. EM was the best in 2017 and then the worst in 2018.

Past Performance Is…

Today a lot of investors are experiencing FOMO because they didn’t own enough Tech stocks in 2023. A small number of stocks (seven, in fact) crushed the rest of the US stock market as well as the other categories. There is a palpable frustration to have a diversified portfolio and lag funds which are concentrated in a few growth names.

This January, investors are looking at their 401(k) or IRA statements and wondering if they should make a change. They see that the XYZ Growth fund was up 40% last year, and it is tempting to drop their diversified portfolio in favor of a fund that performed better last year.

This is performance chasing. It is abandoning the benefits of diversification in favor of betting on what has been hot recently. And it is hazardous to your wealth. Often, what is at the top one year will under-perform in the following years. If you chase performance, you will often buy a hot sector just as it is about to go cold. And then you find that you are switching funds every year because there is always a “better” fund. Just remember, past performance is no guarantee of future results!

Valuations Matter (Eventually)

Today’s market has some similarities with the Tech Bubble in 1999. People got very excited about a relatively small number of Tech companies and bid them up to expensive valuations. Those stocks became quite bloated and drove up the multiple of the entire US stock market. In the frenzy, there were a lot of people who bought tech funds at or near the top. They were late to the party and missed the big gains in 98 and 99, but were invested very aggressively when the bubble burst in 2000.

Stocks were so overvalued that we had three years of subsequent losses in the S&P 500: 2000, 2001, and 2002. That had never happened before. The amount of wealth that was wiped out in the Tech Bubble was truly staggering. The bubble seems pretty obvious in hindsight, but human nature has not improved since 1999. We are prone to make the same mistakes.

I don’t know that we are in a new Tech Bubble, but the lesson remains the same. We don’t chase performance, we invest based on valuation. Our portfolios are diversified across many categories, and rebalanced annually. We use index funds and focus on keeping costs and taxes low.

Our tilts towards areas of greater expected return actually means that we do the opposite of performance chasing. We prefer to buy what is on sale, cheap, and out of favor. We are looking for the categories in the lower half of the chart to return to being in favor. This is a disciplined, long-term process which has worked over time. (See: Our Investment Themes for 2024.)

Reversion To The Mean

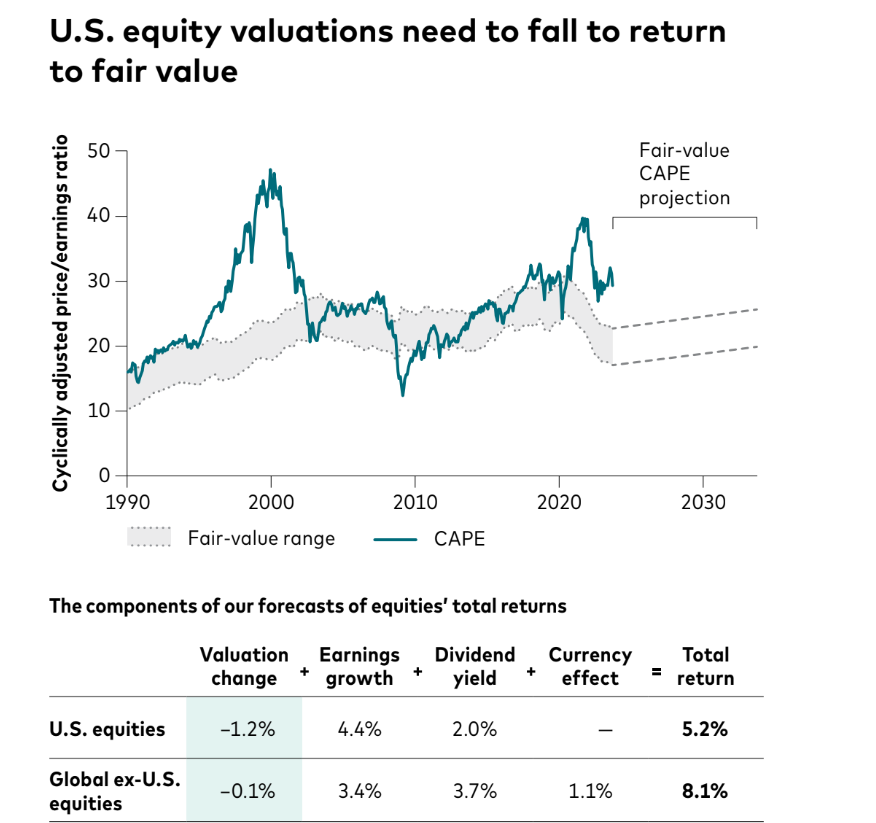

In the short run, expensive stocks can still go up in price if there are enough buyers. That’s where we are today, but the party won’t last forever. US Growth stocks are expensive and have a lower expected return going forward. The expensive valuations are expected to gradually revert down towards historical levels. And the inexpensive categories have room to return to more normal valuations. The chart below shows Vanguard’s projected returns over the next 10 years.

Over the next decade, Vanguard forecasts US Equities to have an annualized return of 5.2%, versus 8.1% for International Equities. With performance chasing is investors are looking backwards. They project recent returns into the future (Google “recency bias“), rather than recognizing that returns average out over time. Instead of piling into the hot stocks, sectors, or categories, investors should stay diversified and also own the categories which have under-performed.

Performance Chasing is a constant temptation because a diversified portfolio will (by definition) always lag some small subset of the market. There is always a hot category. Unfortunately, no one has a crystal ball to predict what will be the next hot investment and jumping around is more likely to harm than help returns. Thankfully, investors are well-served by ignoring the noise and staying on course with a diversified portfolio designed for their needs and long-term goals.