Building wealth is a long-term process, a habit rather than a single event. Being a successful investor requires patience and determination, which can be challenging when there are so many distractions to drag us off course. 2024 is turning out to be an excellent year for investors, but there is so much uncertainty and negativity, it can be tough to maintain our focus.

Unfortunately, the more easily we are distracted from our plan, the more we are tempted to change direction with our investments. Tinkering with a long-term plan because of short-term thinking, often hampers returns rather than improves returns. The urgency of “don’t just sit there, do something!” can lead investors to do the wrong thing at the wrong time.

Election Years

This election cycle is certainly unusual and polarizing. Some people are excited about their candidate. Both sides insist there will be catastrophic consequences if their opponent wins. And, I think a lot of people are disappointed that with 340 million people in the US, these were the two best people we could find to run for president.

Yes, elections matter a great deal. The economy, taxes, laws and regulations, foreign policy, and many other things could get worse. But, change may be slow to come and could be reversed by a subsequent administrations. Regardless of who wins, a dysfunctional Congress seems likely to continue.

Nervous investors are starting to ask if they should change their portfolio or go to cash. We won’t be recommending that or making changes to our portfolio models based on the fact that it is an election year. Vanguard has found that markets performed well under both Republican and Democratic presidents, without a statistically significant difference. And election years, although volatile, had comparable returns to non-election years. (Actually slightly better, on average.) In other words, thinking about making big changes to your portfolio because of the election is likely to be a bad idea.

Behavioral Finance and Cognitive Biases

It can be difficult to stick with a long-term portfolio because we are wired to think about immediate dangers rather than growth over 10, 20, or 50 years. Our minds are incredible computers, but sometimes our mental shortcuts encourage decisions which are not in our best interest. The science of Behavioral Finance has categorized many of these cognitive biases. Even experienced investors have to guard against making decisions which distract us from our long-term wealth building process. For example,

- Herd behavior. Everyone else is buying Nvidia, so should you! You don’t want to miss out.

- Hot Hand Fallacy. Nvidia is up 154% over the past year, so it should continue to have fantastic returns.

- Recency bias. We focus on the performance of tech stocks over the past 12 months, and forget about the performance of tech stocks in 2000-2001. (People remember recent events better than past events.)

- Confirmation bias. You seek out evidence which supports your beliefs, but ignore other evidence which might challenge your beliefs.

- Hindsight bias. Looking back on past events and thinking that the outcomes were obvious and predictable.

And then there is the GI Joe Fallacy: the mistaken assumption that knowing about a bias is enough to overcome it. So, even if you know about cognitive biases, there is no guarantee that your thoughts are not being filtered through your biases. Hopefully, though, being aware of these biases can help you continually question your thought process and decisions.

Instead, Ask Yourself

Let’s reframe our five biases above into more rational questions or statements.

- Herd behavior: Is NVDA still a good value today or are there other stocks which might offer a more compelling return going forward? (Note, talking about the stock is not the same as talking about the company. A great company is not a good investment if the price is too high.)

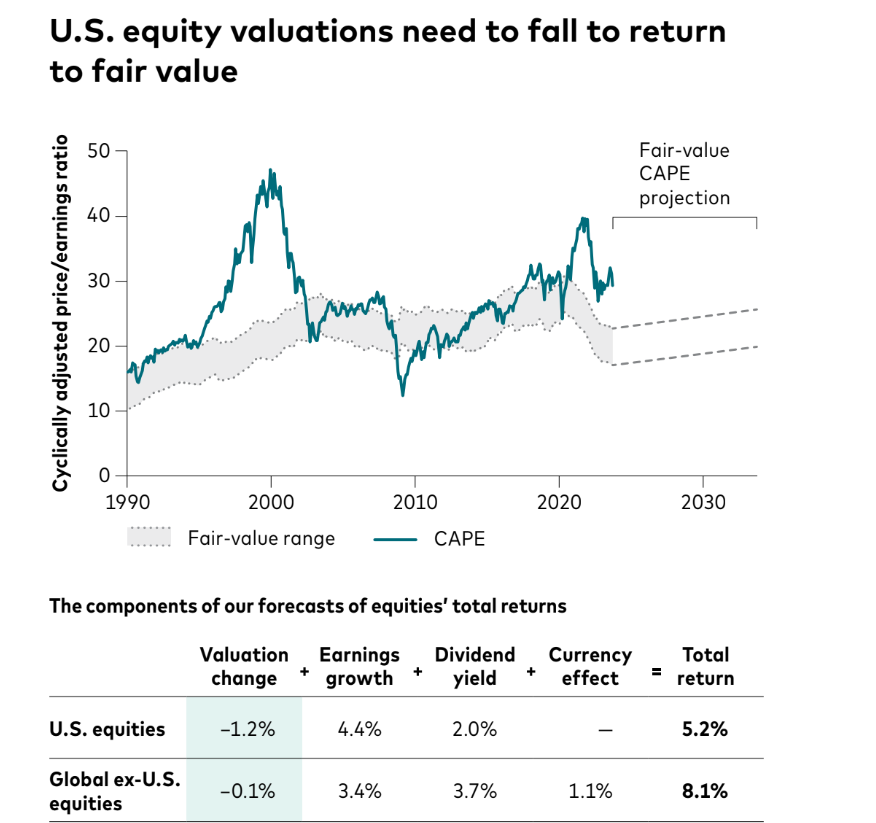

- Hot hand fallacy: NVIDIA is up 154% today. Past performance is no guarantee of future results. If anything, you might expect returns to be mean reverting, rather than continuing to go parabolic forever.

- Recency bias: Forget about the past 12 months. What are the expected returns for the next 10 years? What can we learn from historic situations which were like today?

- Confirmation bias: Continually ask yourself: Am I willing and able to change my mind if there was enough evidence? Seek out that evidence and review it objectively.

- Hindsight bias: Recognize that there were other outcomes which could have occurred. Keep a journal of your decisions and review them in a year or two. (I publish my annual Investment Themes on my blog and track the results.) This will keep you humble.

Less is More

There will undoubtedly be tough times in the stock market at some point in the future. I’m not here to paint a rosy picture where everything will be easy. Concerns about the elections, economy, debt, etc. have their merit. Still, I don’t know of anyone who has been able to time the market. And people who think the sky is falling have not participated in remarkable gains over the past decade. What has worked is to be a buy and hold, long-term investor. So, here is how we invest in a systematic manner to avoid the cognitive biases and errors:

- Index funds. Buying 500 stocks is a lot less risky than buying one stock. I would rather invest in the whole market than bet on one stock. Individual companies can and do go out of business. 80-90% of stock pickers under-perform their benchmark over 5 years or more.

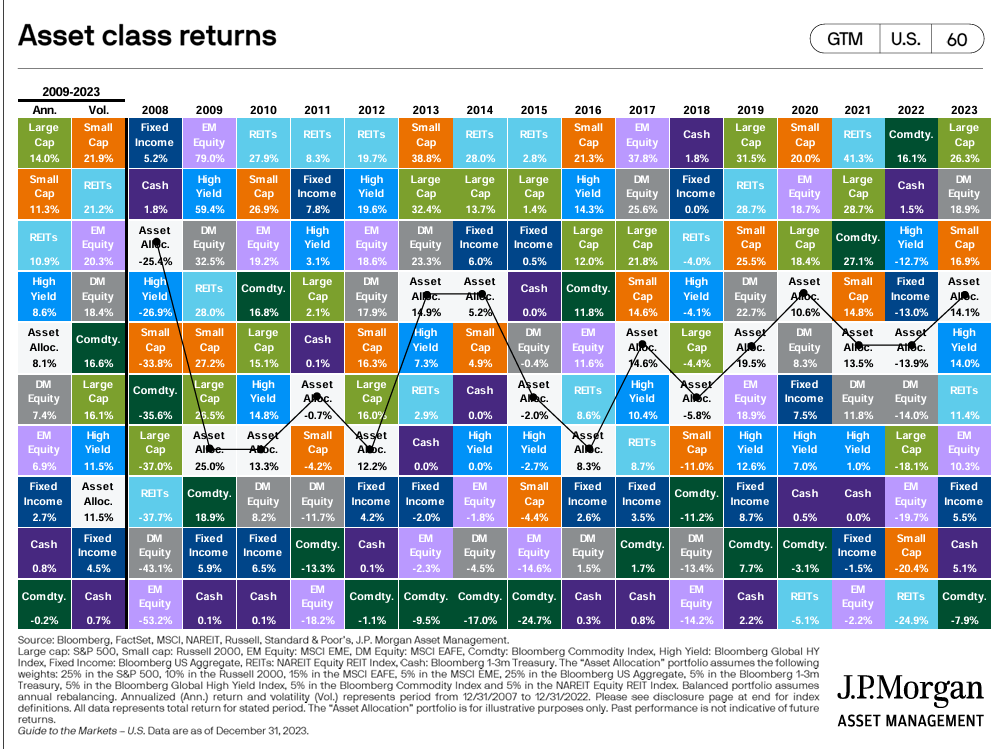

- Focus on asset allocation. What is your mix of large vs. small, US stocks vs. international, and stocks vs. bonds? Most of the difference in returns is determined by your asset allocation.

- Keep costs, taxes, and trading to an absolute minimum.

- Rebalance. Rebalancing is a systematic way to buy stocks when they are cheap and sell them when they become more expensive. Rebalancing helps you maintain your desired level of risk.

- Invest as is appropriate for your risk tolerance and time horizon. And then leave it alone, knowing that there are up years and down years in the market.

The news seems to be becoming more and more of a circus. The risk of distraction could scare investors to sell everything and go into cash, or to chase performance on today’s hot stocks. Our recommendation is to ignore the election hype. Educate yourself on cognitive biases and understand that markets have up and down cycles. All of this will lead you to recognize that no one can predict what the markets are going to do over the next 6-12 months. But the markets are so often growing that being out of the market for a year usually proves to be a mistake. And when the market is on a roll, there is the danger of getting too enthusiastic about individual companies and ignoring fundamentals. Avoid making big mistakes and stick with the plan!