With all the noise in today’s markets, it is easy to miss the big picture about growth. 2022 and 2023 have been two of the strangest years in a generation for investors. As a result, it is easy to feel uncertain about investing right now. And that uncertainty often leads investors to make bad choices. So, we are going to step back and look at the 30,000 foot view of what really matters for investors.

In 2022, we saw inflation rise to 9% and the Federal Reserve start the process of slowing the economy. As the Fed raised interest rates, stocks dropped 20%, briefly entering Bear Market territory. In the bond market, rising interest rates snipped the price of bonds, sending the US Aggregate bond index down double digits. For diversified investors, 2022 was a perfect storm where diversification failed and both stocks and bonds were down an uncomfortable level.

Now in 2023, we have seen the Federal Reserve continue to raise rates up to the present moment. At the start of the year, I saw one report that said the probability of a recession in the next 12 months was 100%. 100%, a certainty! And while the full 12 months are not up yet, we have not had a recession. In fact, the S&P 500 Index is up 15.83% this year. While the yield curve remains inverted, a favorite predictor of recessions, it now appears that the likelihood of a 2023 recession is diminished and might not happen at all.

Don’t Time The Market

Comparing 2022 and 2023 doesn’t make sense. The market “should” not be up 15% this year. And yet here we are, with a very welcome gift of an amazing performance in the first seven and a half months of the year. The consensus economic forecasts at the start of 2023 were lousy. If we had listened to them, we would have sold our stocks and hid out in cash. We would have missed out on the gains that we have had for 2023!

There are often compelling historical precedents to entice investors to think we can predict what is going to happen over the next 12 months. Making changes to your investments feels obvious, a smart choice, and low-risk. Unfortunately, history shows us that it is hubris to try to time the market and more often detrimental than beneficial.

It is a challenge to actually stay the course and maintain your discipline. It is difficult to ignore the forecasters and not think that there is an opportunity for you to either protect your principal or rotate into a better performing investment.

Timing the market continues to be a bad idea. I didn’t hear any forecasters in January predict that stocks would be up 15% by August. If we had listened to their predictions, although well-intentioned, we would have made a mistake. Thankfully, we didn’t try to time the market this year. Here is how we manage a portfolio:

- Establish a target asset allocation for each client’s individual needs and risk tolerance.

- Rebalance portfolios when they drift from the targets.

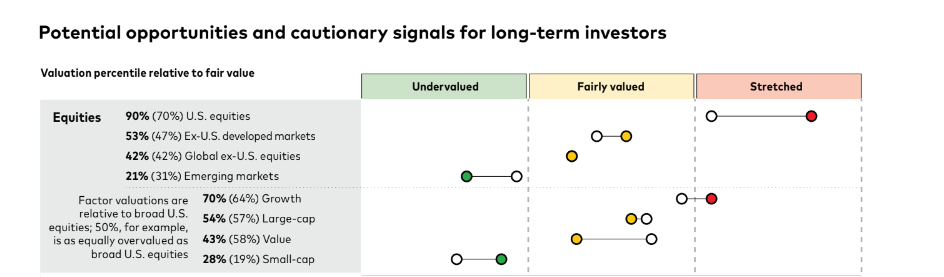

- Adjust our portfolio models annually based on the valuation and expected returns of each category.

- Use Index Funds and manage each client’s portfolio to keep costs down and minimize taxes.

Rebalancing

The funny thing about rebalancing is that it often means doing the opposite of what you might expect. When stocks were down 20% last year or in 2020, we were buying stocks. Now, when stocks are up 15-20% and there is a lot of optimism for a soft landing, we are trimming stocks and buying bonds. In hindsight, this looks pretty logical. However, in real time, rebalancing often feels like not such a good idea. And sometimes it isn’t – there’s no guarantee that rebalancing will improve returns. But, what it does offer is a disciplined process to managing an investment portfolio, versus the behavioral traps of trying to time the market. The bizarre markets of 2022-2023 certainly reinforce the potential benefits of rebalancing.

Average Versus Median

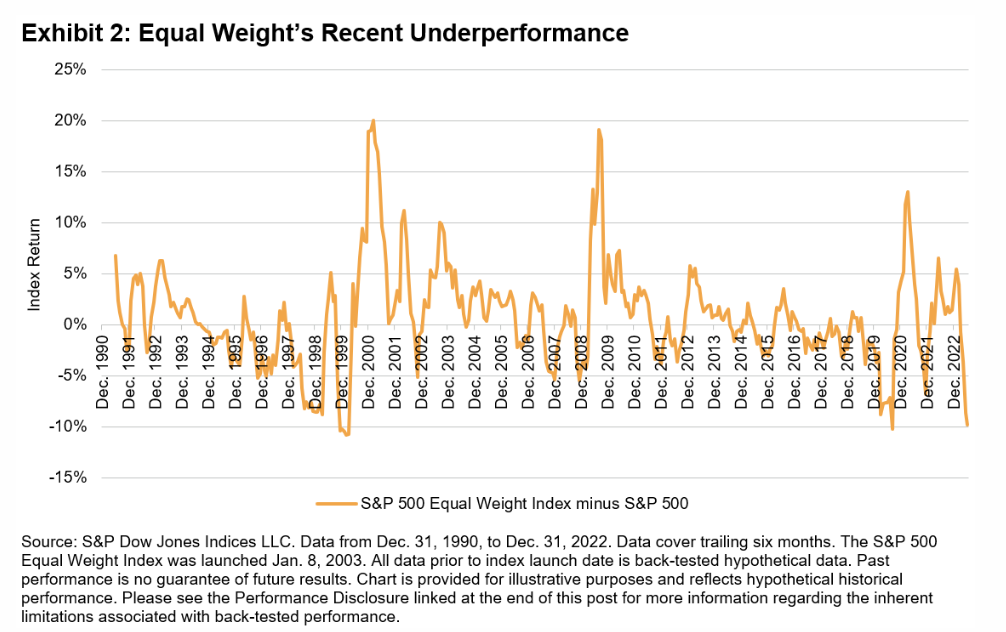

Do you remember from high school algebra the difference between Average and Median? Average is the total sum divided by the number of items. Median is the data point in the middle. And there can be a big difference between Average and Median. Stock markets are cap weighted, so the larger stocks move the index more than the smaller stocks. Still, let’s consider how the “average” return of an index can be quite different from the median returns of its component stocks.

The year to date return of the S&P 500 Index ETF (SPY) is 15.83% as of August 16. But that is not the median return of the stocks. Of 504 components of the S&P 500, only 135 have done better than 15.83% YTD and 369 have done worse than the overall index. If you had picked a random stock from the S&P, there was a 73% chance that you would have done worse than “average” this year.

And what is the Median performance of the S&P 500 this year? Only 3.36%, an under-performance of more than 12% than the overall index. Even worse, 212 stocks in the S&P 500 are down, negative for the year.

What is the big picture of growth in stocks? Trying to pick individual stocks is extremely difficult. Don’t think that using an index fund means “settling for average”, the reality is that over time, the index return has done much better than the median stock.

This year has been such a frustrating year for investors because stocks are all over the place. If you don’t own a few of the top performers, you are likely lagging the benchmark by a wide margin. What is a way to make sure you own the winners today and tomorrow? Own the whole market with an Index Fund. Realize that if you pick a stock from the S&P 500, it is not a 50/50 coin toss that you will beat the market average. The chance is lower than 50% because the market average typically does better than the median stock. The stocks which do outperform will move the index disproportionately and they will be fewer in number.

There is a lot of noise and confusion in the markets today, and that’s okay. We are in uncharted waters and seem to be going from one “unprecedented” event to another. Thankfully, I don’t think we need to have a crystal ball to be successful as long-term investors. What I believe can help is stepping back to remember the big picture: don’t time the market, stick to an allocation and rebalance, and use index funds. That’s our roadmap. When in doubt, we can recheck our directions and keep going.

What You Can Control

In the short-term, stock markets can be very volatile. As a result, I believe a lot of inexperienced investors mistakenly think that their success depends on their ability to game the markets. They think that growth is achieved through trading or superior returns.

Unfortunately, trying to outsmart the market often makes your performance worse, rather than better. Active management doesn’t work, at least not consistently over 10 or more years. We stick to passive, low-cost index funds or ETFs for our stock market exposure. And we remain invested in a long-term asset allocation.

Once that investment decision is out of the way, the main determinant of success is your savings rate. How much are you investing each month? That is what you can control. If you want to be more successful in accumulating your wealth, you don’t need to worry about the Jobs Report this week, or what was in the Federal Reserve meeting notes. You need to focus on how can you can save an extra $100, $500, or $1000 a month and make that a habit.

Instead of worrying about your YTD performance, calculate how much wealth you will have in 10 or 20 years, with an average rate of return. Because in the long-run, an average rate of return is excellent. And then what you can control – your savings – is what actually matters more. Growing your wealth is largely a factor of savings and time. Chasing investment performance is a distraction.

Develop Your Saving Habits

- Make savings automatic. Put your investing on autopilot with monthly contributions to your 401K, IRA, and investment accounts.

- Save More. Don’t just do the 401(k) match, try to put in the maximum to each account. And then ask where else can you invest? Do the math of how much money you want to accumulate. (I can help with that.)

- Keep the big expenses down. Living beneath your means is easy if you are smart about your housing costs and your cars. Many Americans who are not frugal in those areas do not have anything leftover to invest.

- Develop your career. If you can expand your income without increasing your expenditures, your savings can increase dramatically. If you ever have a chance to work for a company with stock options, go there. I have seen over the years, tremendous wealth accumulated from stock options.

- Be an Entrepreneur. This can be high risk, but when they are successful, entrepreneurs earn and save much more than employees. Besides a salary, an entrepreneur is growing a business that has value.

As a financial planner over the past 19 years, I’ve gotten to look at a lot of families’ finances. The difference between those who were struggling and those who were wealthy was seldom just income. I’ve seen a lot of high income folks who were living hand to mouth. Other families who had similar incomes were millionaires or well on their way. The difference was their saving rate. You can’t grow what you don’t save.

There is no substitute for saving. We have to make savings automatic and increase our savings whenever possible. It may help to work backwards: start with your goal and determine how much you need to save and for how long. Then you can see saving as the solution and beneficial process rather than as a sacrifice. Some Americans are saving very well. But the Big Picture is that the average American isn’t saving enough. We need to be talking more about saving, because for too many families, it is the step that they cannot get past.

Our recipe for Growth is simple. Save monthly and dollar cost average into Index funds. You can do this in your 401(k), IRA, or taxable account. The account is less important than the process. The more you save, the more wealth you can accumulate. The younger you start, the better. The faster you increase your saving, the sooner you can reach your goals. Saving is growth and investing is secondary.

Investment Taxes Eat Your Growth

Taxes matter. We work hard to establish a good portfolio and get a respectable rate of return. And then the government wants their cut. How about 37% for Federal Income Taxes (increasing to 39.6% in two years). And another 5% for state taxes. Don’t forget 15.3% for self employment taxes for Social Security and Medicare (or half that number if you’re an employee). Then, if you do well, how about an extra 3.8% in Medicare surtax (“Net Investment Income Tax”).

Once you have your “after-tax” money, it’s all yours, right? Well, not quite. You get to give the government another $5,000, $10,000, or more in property taxes. And when you want to buy something with your after-tax money, you get to pay 8% in sales tax.

The point is that it doesn’t matter how much you make, it matters how much you keep. That is why tax planning is such a big part of our wealth management process. As your portfolio grows, the tax implications can become a significant annual expense and a drag on returns.

What continues to shock me is how many Advisors are making huge mistakes with client portfolios and creating tens of thousands of dollars in unnecessary taxes. Taxes which could have been avoided or reduced substantially through better planning. Sometimes this is because they use a model portfolio that doesn’t attempt to have any tax efficiency. But other times, it is laziness and having too many clients to manage individual portfolios in a tax-efficient way. It’s easier to stick people into a model and let the computer automatically rebalance the portfolio.

This is the big picture for wealthy Americans: Your after tax-return matters more than your pre-tax returns. You have very little control over taxes on a monthly basis, but a great deal of control over taxes in the long run. Here are the mistakes we often see and how we can do better:

Portfolio Tax Efficiency

Mistake 1: Mutual Funds in Taxable Accounts. Mutual Funds have to distribute capital gains annually. Each December, many investors get a surprise tax bill from their funds. BETTER: hold Exchange Traded Funds (ETFs) in taxable accounts. ETFs rarely, if ever, have capital gains distributions.

Mistake 2: Short-Term Capital Gains. Short-Term Capital Gains (less than 1 year) are taxed as Ordinary Income, up to 37%. BETTER: Hold for Long-Term Capital Gains (more than 1 year), which are taxed at lower rates (0, 15 , or 20 percent). Trading which creates ST Gains should be avoided in a taxable account. We are very careful about the tax implications of our rebalancing trades, as well.

Mistake 3: Bonds and REITs in Taxable Accounts. Bond income is taxed as ordinary income (up to 37%). BETTER: Hold bonds in IRAs, which are tax-deferred. Also, IRA distributions will be taxed as ordinary income, so bond income isn’t treated worse in an IRA, unlike capital gains. When you have a LTCG on a stock ETF in an IRA, all that growth will be taxed as Ordinary Income. Traditional IRAs will have the highest tax rate, so it is better to allocate the low growth bonds to IRAs and high growth stocks to Roths and taxable accounts. This process is called Asset Location.

Mistake 4: Not harvesting losses. BETTER: Harvest losses annually in taxable accounts. Losses can be used to offset gains that year, and $3,000 of losses can be applied against ordinary income. Unused losses will be carried forward without expiration.

Mistake 5: Not asking about charitable giving. 90% of Americans are not itemizing and not getting any tax benefit from charitable donations. BETTER: We can get a tax benefit two ways, without itemizing: A) make donations of appreciated securities from a taxable account. Or B), if over age 70 1/2, make Qualified Charitable Distributions (QCDs) from your IRA.

Mistake 6: No Plan for Managing IRA Distributions. BETTER: Do Roth Conversions in low income years before RMDs start at age 73.

Mistake 7: Not understanding Taxes that will be owed by Beneficiaries. BETTER: Working with your Advisor to consider inter-generational taxes in your Estate Plan. For example, taxation of trusts, step-up in cost basis, charitable giving, and Beneficiary IRAs.

Mistake 8: Not doing a Backdoor Roth IRA. I’ve had advisors tell me it’s not worth their time to move $13,000 to $15,000 into a TAX-FREE account each year for a married couple. Not worth it for the advisor, I guess (no additional revenue). BETTER: Although the numbers are small annually, we have been doing back-door contributions for clients for many years, and it does add up.

The Changing Retirement Picture

Did your parents retire with a Pension? Maybe they worked for 30-40 years for the big company in town, or for a municipality, school district, military branch, or government agency. When they retired, they had a pension and Social Security which fully covered their expenses. They might have also had retirement health benefits which paid for deductibles and co-pays which were not covered by Medicare.

You probably don’t have the same benefits. How much is a Pension worth? Well, we can easily compare a Pension to the cost of a Single Premium Immediate Annuity, or SPIA. A SPIA works the same way as a Pension – it is a guaranteed monthly payment for life. For example, let’s consider a 65 year old female who has a pension which guarantees her $2500 a month for the rest of her life. We could buy a SPIA with the same guaranteed $2,500 a month for life, for a cost $437,063. So, a $2,500/month pension is worth $437,063.

To have the same retirement funding as your parents, you may need $400,000 or more in assets than they had. And that is just to replace one modest pension. If your parents had two pensions or had a bigger pension, you might need much more than $400,000 to get the same retirement income.

And you probably won’t buy a SPIA and would prefer to keep your money in an IRA. At a 4% withdrawal rate, you would need $750,000 in your IRA to get $2,500 a month. So maybe you need $750,000 more than your parents, not $437,000, to replace their pension! These pensions were worth a lot. It will take a worker 30 years of saving to build up their 401(k) to $750,000. It’s not impossible, but the big picture is that most Americans aren’t doing a good job of saving. The average 401(k) balance for workers age 55-64 is $207,874. The median balance at 55-64 is only $71,168, meaning that half of all 401(k) accounts are less than $71,168.

I’m afraid the promise of becoming wealthy through your 401(k)s has proved elusive for the average American. It’s a wedge that is driving wealth inequality in our country. But I don’t think Pensions are coming back – retirement preparation rests squarely on the individual’s shoulders. You certainly can get to $500,000 to $1 million in a retirement account, but you have to aim to put in the maximum, not just get the company match. Then you have to not withdraw it and let it compound for 30 to 40 years. That recipe will work, but it’s not easy, it requires some sacrifice and a lot of discipline.

Counting on Social Security

The Social Security Trust Fund will be depleted by 2033. After that, revenues will only cover about 70% of promised benefits. After kicking the can down the road for 20 years, Washington needs to get its act together soon. We can either reduce benefits or increase taxes. It may be a combination of both, but one thing is for sure: keeping the status quo is not going to be an option. The Social Security budget for 2023 is $1.30 Trillion. The Department of Health and Human Services (Medicare, Medicaid, and other health agencies) have a budget of $2.10 Trillion for this year. These two programs, largely for Retirees, have become the biggest portion of government spending.

There will have to be a reckoning in the years ahead about these programs. Something has to change, they are unsustainable in their present form. I think there will be changes in inflation adjustments, a gradual increase in the full retirement age, and probably some means testing which will reduce benefits for high net worth families. Or there could be a whole new system. As difficult as it is to imagine, the system is so broken that starting over from scratch might be better than continuing to try to put new band-aids on this fiscal cancer.

The big picture for the future of government retirement programs is very uncertain. These are not the only issues facing the government. Our debt is growing. This year, the interest payments alone on US Treasury Debt will be $964 Billion. We may top $1 Trillion in interest payments next year. And there is no plan to ever repay this debt, only to grow it every single year. When you look at debt projections, it only reinforces the need to reign in the expenses which are growing the fastest.

In our planning process, we include Social Security projections. But we had better be prepared for benefits to potentially be a bit less than promised. So, once again, it may be that more of your retirement income needs to be self-funded. If you don’t have a pension, the burden of funding your retirement has been shifted to you. Have you calculated what that will cost? That’s what we do with our retirement planning software, MoneyGuidePro. We create an ongoing plan for your retirement needs, which adjusts over time, and where we can continue to refine assumptions and expectations.

I hate to be such a downer, it’s really not my nature. But a lot of Americans are going to have worse retirements than their parents, because they don’t have a pension. The burden of saving for retirement has shifted from the employer to the employee. Now instead of everyone getting a good outcome, many Americans are under-prepared for retirement. And then we have to look ahead at the uncertainty that is facing Social Security and Medicare. It looks like we will have more individual responsibility for our outcomes and less universal assistance.

The Forest For The Trees

The Big Picture for Growth can be hard to see because the fog of current events makes it hard to see the long-term horizon. Here are our four pillars of The Big Picture:

- Don’t time the market. Stick to your asset allocation and rebalance. Use index funds.

- Once you’ve made the shift away from performance chasing, focus on what really matters: how much you save.

- Taxes hurt returns. Tax planning helps.

- You are responsible for your own retirement savings and financial security.

I’m sure things are going to change. We don’t really know how, when, or why they will change. While some may find uncertainty to be paralyzing, it doesn’t have to be. Even if the future is a moving target, planning is not a waste of time. Not at all! Being well prepared also includes the flexibility to adapt and evolve.

A lot of my day to day work is focused on the small details of implementing our plans. But the growth is created when we step back and take a long, hard look at The Big Picture. We should all be having more of those conversations, with our spouses and children, our bosses and colleagues, and especially with your financial professional.