Fixed Income is an essential piece of our portfolio construction, a component which can provide cash flow, stability, and diversification to balance out the risk on the equity side of the portfolio. Although fixed income investing might seem dull compared to the excitement of the stock market, there are actually many different categories of fixed income and ways to invest. As an overview, we’re going to briefly introduce the various tools we use in our fixed income allocations.

1) Mutual Funds. Funds provide diversification, which is vitally important in categories with elevated risks such as high yield bonds, emerging market debt, or floating rate loans. In those riskier areas, we want to avoid individual securities and will instead choose a fund which offers investors access to hundreds of different bonds. A good manager may be able to add value through security selection or yield curve positioning.

While we largely prefer index investing in equities, the evidence for indexing is not as conclusive in fixed income. According to the Standard & Poor’s Index Versus Active (SPIVA) Scorecard, only 41% of Intermediate Investment Grade bond funds failed to beat their index over the five years through 12/31/2014. Compare that to the 81% of domestic equity funds which lagged their benchmark over the same five year period, and you can see there may still be an argument for active management in fixed income.

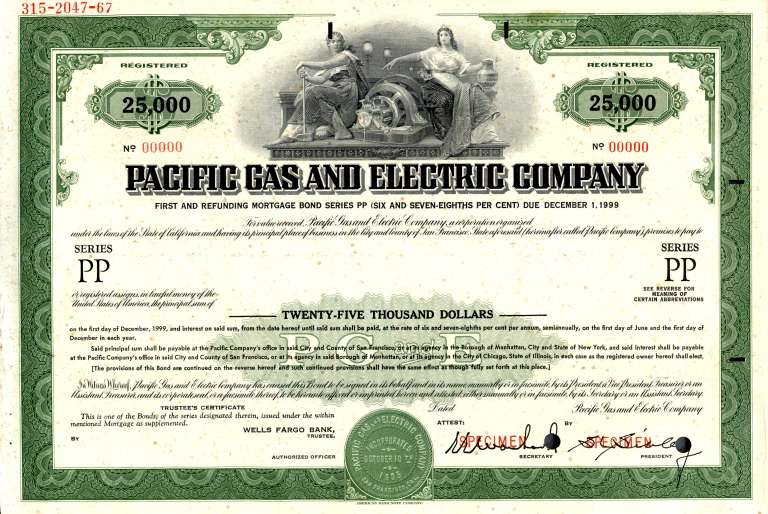

2) Individual Bonds. We can buy individual bonds for select portfolios, but restrict our purchases to investment grade bonds from government, corporate, and municipal issuers. The advantage of an individual bond is that we have a set coupon and a known yield, if held to maturity. While there will still be price fluctuation in a bond, investors take comfort in knowing that even if the price drops to 90 today, the bond will still mature at 100. It’s difficult for a fund manager to outperform individual bonds today if their fund has a high expense ratio. You cannot have a 1% expense ratio, invest in 3% and 4% bonds, and not have a drag on performance.

Those are the advantages of individual bonds, but there are disadvantages compared to funds, including liquidity, poor pricing for individual investors, and the inability to easily reinvest your interest payments. Most importantly, an investor in individual bonds will have default risk if we should happen to own the next Lehman Brothers, Enron, or Detroit. Bankruptcies can occur, and that’s why we only use individual bonds in larger portfolios where we can keep position sizes small.

3) Exchange Traded Funds (ETFs). ETFs offer diversified exposure to a fixed income category, but often with a much lower expense ratio than actively managed funds. ETFs can allow us to track a broad benchmark or to pinpoint our exposure to a more narrow category, with strict consistency. Fixed income ETFs have lagged behind equity ETFs in terms of development and adoption, but there is no doubt that bond ETFs are gaining in popularity and use each year.

4) Closed End Funds (CEFs). CEFs have been around for decades, but are not well known to many investors. Closed End Funds have a manager, like a mutual fund, but issue a fixed number of shares which trade on a stock exchange. The result is a pool of assets which the fund can manage without worry about inflows or redemptions, giving them a more beneficial long-term approach. With this structure, however, CEFs can trade at a premium or a discount to their Net Asset Value (NAV). When we can find a quality fund trading at a steep discount, it can be a good opportunity for an investor to make a purchase. Unfortunately, CEFs tend to have higher volatility than other fixed income vehicles, which can be disconcerting. We don’t currently have any CEF holdings as core positions in our portfolio models, but do make purchases for some clients who have a higher risk tolerance.

Where fixed income investing can become complicated is that within each category (such as municipal bond, high yield, international bond, etc), you also have to compare these four very different ways of investing: mutual funds, individual bonds, ETFs, or CEFs. They each have advantages and risks, so it’s not as easy as simply choosing the one with the highest yield or the strongest past performance. And that’s where we dive in to each option to examine holdings, concentrations, duration, pricing and costs.

There are other ways to invest in fixed income, such as CDs, or annuities, and we can help with those, too. But most of our fixed income investing will be done with mutual funds and ETFs. In larger portfolios, we may have some individual bonds, but will always have funds or ETFs for riskier categories.

Investors want three things from fixed income: high yield, safety, and liquidity. Unfortunately, no investment offers all three; you only get to pick two. Where we aim to create value is through a highly diversified allocation that is tactical in looking for the best risk/reward categories within fixed income.