Leading up to the last financial crisis, bankers made hundreds of millions by packaging together mortgages and selling them. They were paid upfront and had no repercussions when those mortgages went into foreclosure and both the homeowners and investors lost money. The asymmetry that bankers had an enormous upside to sell something but shared none of the downside risk led to catastrophic losses.

This is the subject of Skin In The Game, a new book by Nassim Nicholas Taleb, perhaps the foremost writer on risk and the practical application of the mathematics of probability. I’ve just finished the book and while it was not an easy read, its ideas are relevant to investors.

Skin in the game – having shared risks and rewards – is essential for investors to achieve better outcomes with their advisors and investment managers. Taleb points out interesting and not always obvious situations where these asymmetries present potential pitfalls in investing, politics, economics, and everyday life.

Investors would be well-served to think about whether their advisors have skin in the game and aligned interests, or if they are like the bankers who win regardless of whether their clients profit or not.

Before starting my own firm, I worked at two companies for 10 years. I had one colleague, who in spite of making a lot of money over many years, actually had less than $50,000 in investments. His top priority was paying down his mortgage. He talked about investments all day long yet had almost no interest in putting his own money in what he recommended to clients.

Another colleague invested significant sums every month and became one of the three largest clients of the firm. And every purchase was into the exact same funds as our clients. Which of those Financial Advisors would you prefer to manage your money? One who didn’t want to invest or one who couldn’t get enough of the funds we bought for clients?

Strangely, to me at least, clients rarely ask questions about Skin In The Game. I became a Financial Advisor because I was fascinated with investing and found myself spending all my evenings and weekends reading everything I could find and investing every dime I could scrape together. I opened my firm with one purpose: to treat every client as I would want to be treated.

That’s why I’d encourage investors to think and ask about Skin In The Game. Here are some ways to do that:

1. Doing not Saying. If you really want to know what people believe, find out what they do, rather than what they say. Understanding the difference is a BS-detector. Do you invest in this fund? How much of your net worth is in this strategy? Have you bought this investment for your mother’s account? Those answers, if you can get an honest one, are more telling than any pitch. In other words, don’t buy a Ford from someone who drives a Toyota.

2. Appearances. Taleb is trying to choose between two surgeons: one has an Ivy League undergraduate diploma, and wears immaculate bespoke suits. The other wore rumpled clothes, was a bit slovenly, and came from a middle class background. Taleb suggests choosing the latter surgeon, because he had to work much harder to achieve his career and is therefore likely more skilled. The first was more successful in looking like a surgeon rather than being the best possible surgeon.

(Thank you to all the clients who have hired a former music teacher to manage millions of their dollars. I used to get up at 5 am for years to study for the CFP and then CFA exams before going to work. It hasn’t been an easy road.)

3. Simple is better than complex. Complex solutions are sometimes created as a hook to sell something. Often, a simple, well-tried approach is more effective. Convoluted structures conceal many flaws, hidden fees, and conflicts of interest. If something seems unnecessarily complex, that’s a red flag.

4. “Scientism”. Facts and book knowledge can be bent to your point of view. Consider for example: “homeowners have 30-times the wealth of renters”. I heard this statement this week, along with the conclusion that buying a house therefore causes wealth. Correlation is not causation! You could also reach the opposite conclusion: you have to be very wealthy to afford a house in America.

Both are flawed because the thought process of going from the fact to the conclusion is biased. If I got an apartment, would I become poor? No, of course not. Taleb calls this “Scientism”, dangerous ideas which sound scientific, but don’t actually follow the objective hypothesis-testing process demanded by real science.

You cannot become wealthy without taking risks. The best way of ensuring a good outcome is through the fairness of symmetry and shared risks. That means both sides have an upside and a downside.

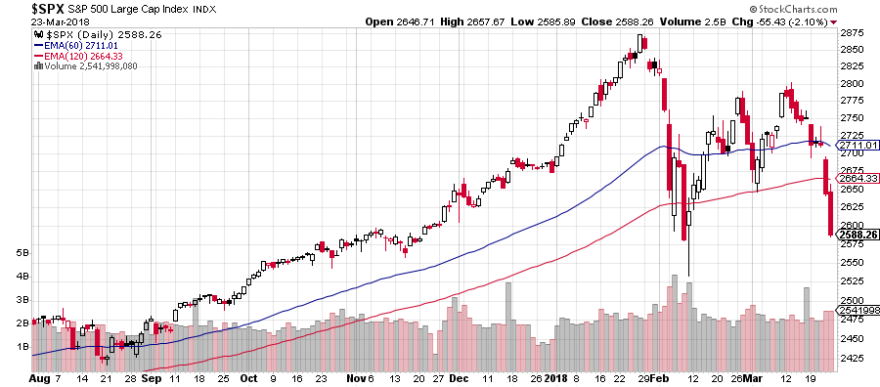

I don’t have a crystal ball about what the market will do, but I do invest in the same ETFs and Funds as my clients (I use our Growth Portfolio Model). By having Skin In The Game, I think it does provide an important motivation to spend extra time on due diligence, think carefully about risks, and follow our positions closely.