Almost everyone has wondered at sometime: should we invest in real estate? Perhaps it sounds appealing compared to the intangibility and lack of control in the stock market. However, for 90% of the people I meet, I think the answer is a definite no. I’m going to tell you why, and for the 10% of you who might still want to invest in real estate, I’m going to tell you how.

First, let’s get this on the table. Most financial advisors make their living from recommending or managing stocks and bonds, so yes, we have a conflict of interest. Unlike many advisors though, I have some first hand knowledge of real estate. Growing up, my parents purchased, managed, and sold 10 apartments, which in retrospect, was no small feat on teachers’ salaries. The proceeds from selling one property (which contained four apartments) comprised their entire contribution to my college education. It didn’t cover everything (the rest came from student loans, work study, and graduate assistantships), but I know that real estate investing does work and can be a wealth generator. I’m not fundamentally opposed to the idea of real estate investing for the right person who does it wisely.

During my childhood, we spent many weekends mowing lawns, doing maintenance, and interviewing prospective tenants. We cleaned, painted, did plumbing work, and whatever else was needed. The first thing that any potential investor needs to understand is that real estate is not a passive investment; it is a business which makes demands on your time, resources, and patience. Being a landlord is not about bricks and mortar, it’s a people business. Your job is to find, manage, and retain good tenants. Inevitably, you will still encounter the Tenant from Hell who doesn’t pay the rent, steals, vandalizes, and then moves out in the middle of the night owing you thousands. It can be frustrating, time consuming, and at times incredibly stressful.

You’ll never get a call in the middle of the night from your mutual fund because the hot water heater blew up. So trying to compare a real estate business to a passive investment program is apples and oranges. Don’t expect real estate to be easy, regardless of what “reality” program you saw on HGTV. For most people, you are already stretched too thin juggling your career, family, and other interests to want to tackle being a direct investor in real estate. It can detract from your quality of life, and there’s no guarantee of success.

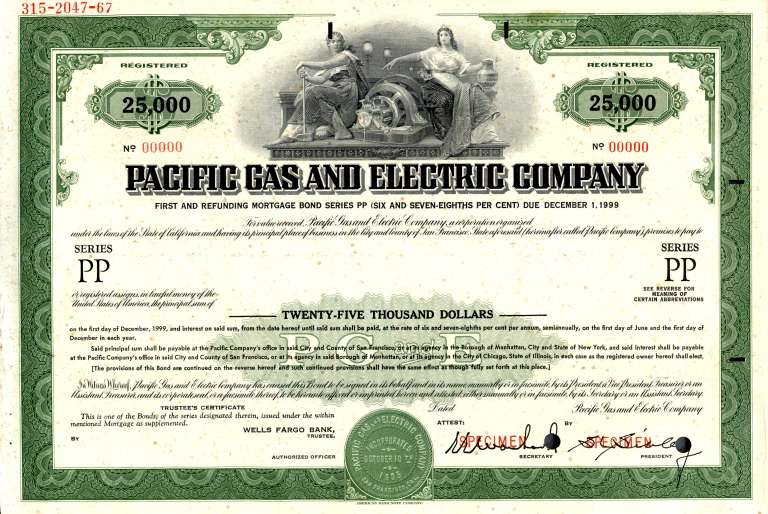

As a stock investor, you can own the whole market with an index ETF and be very diversified. You can buy the same stocks as Warren Buffet, if you want, and get the same return. A person with $10,000 in a fund will receive the same return as someone with $10 million. Fund investing is liquid, requires no effort, and is very democratic, if you will. Real estate, on the other hand, is completely idiosyncratic. Every deal is different. Your neighbor might do well, and you could do poorly. A house in one city might appreciate significantly, but might depreciate in another city. Thinking that you have control over real estate, because it is a tangible item, is an illusion. Buying a house in 2005 could have created a substantial loss, while buying the same house in 2010 may have created a large gain. You have no control over the underlying economic factors which drive real estate prices, just like we have no control over the factors which drive stocks and bonds.

In the last downturn, I know several smart, hard-working people who went into personal bankruptcy because of their real estate investing. It can be risky. If you still want to own real estate, I suggest having it be only a portion of your portfolio, and keep your retirement accounts invested in stocks and bonds. Here are seven tips to keep your investment safe:

1) Get rich slow. Forget about flipping houses. Buy residential properties to rent and plan to hold them for years or decades. Make sure you are investing and not speculating. Buy a house that has good ratio of rent compared to its costs. A $100,000 house that generates $1000 a month in rent is obviously better than a $200,000 house that rents for $1600. The property is an investment, and not for your personal taste, so it does not have to be a luxury home. Wealthy people are not your target tenants. Look for clean, well-maintained properties with access to good schools.

2) Focus on building equity. Use your tenant’s money to pay down the mortgage – that’s how you create wealth in real estate. Get a short note (15 or 20 years) rather than a long mortgage, an interest-only loan, or balloon. Each year, your equity in the property will increase and the amount of interest you pay will decrease. Eventually, you can sell the house for a large gain, or you will pay off the note and then you can bank the rent each month. Don’t make it your goal to have high cash flow from the property for your own income. Invest that cash flow into the equity. And whatever you do, don’t quit your job thinking you will live off your real estate investing – that’s often a disastrous idea. Inflation (rising home prices) should be the icing on the cake; your primary objective is to build equity by paying down debt.

3) Do it yourself. Profit margins are razor thin in real estate. After you pay property taxes, insurance, the mortgage, and maintenance, there is almost nothing leftover. If you plan to hire a handyman every time you need to change a light bulb, you can easily slip into a negative cash flow situation. You have to save money where ever you can, so be prepared to be hands-on. No one will care more about your property than you. Don’t be a long-distance landlord; aim to buy properties within a 10-mile radius of your home. If the idea of sweat equity is a turn-off, real estate is probably not for you.

4) Use leverage wisely. If you have $100,000 to invest in real estate, you could pay cash for one $100,000 house. Or, you could make $20,000 down payments on five houses. Owning five houses will give you better diversification and a much better long-term return because of the leverage. It really is smarter to use the bank’s money for real estate, especially with today’s low interest rates.

5) Keep a strong cash reserve. You will have unexpected expenses, and they can be large. Real estate investors must have a sizable cash position and cannot be living from month to month. Budget for maintenance and vacancy. Will you be okay if you have to spend $10,000 on a new roof or HVAC system? Can you survive if the property is vacant two or four months a year? Know the occupancy rates and market rent rates in your area.

6) Be super organized. Everything needs to be in writing, including applications and lease agreements. Check references for prospective tenants. Keep all receipts and work with a good accountant to track your deductions, depreciation, cost basis, and other tax benefits. This is a business, not a hobby. Treat it seriously.

7) Appreciate your good tenants. They make your life easy, take care of your property, and keep your account in the black. Do nice things for your good tenants and make them want to stay. Their money is building your wealth.

As for me, I spent enough time with apartments to know I’d rather stick with stocks and bonds. It’s a better fit for my schedule and I know myself well enough to know that my efforts are better directed elsewhere. And over the previous 30 years, the nominal return of residential real estate was 4.38% versus 11.09% for large cap stocks. When we include taxes, inflation, and expenses, single family homes returned only 0.80% over those 30 years, compared to 5.97% for large cap stocks. So real estate is often not the home run that people believe it will be.

If you’re thinking about real estate investing, let’s get together and discuss what it entails before you get started.