This week, the stock market threw a tariff tantrum — and for good reason. Economists, business leaders, and investors alike agree: the administration’s sudden new tariffs are bad news.

Starting this week, U.S. tariffs include:

- 20% on imports from the European Union

- 24% on goods from Japan

- 34% on products from China

- Overall range: a minimum of 10%, and up to 50%

While the White House describes these as “reciprocal,” they’re not actually based on other countries’ tariffs on U.S. goods. Instead, the new tariffs are tied to each country’s trade deficit with the U.S. — the higher the deficit, the steeper the tariff.

Why Tariffs Backfire

The logic behind these tariffs might sound simple: make imports more expensive so people buy American. Unfortunately, that’s not how the real world works.

- Other countries are retaliating. They’re imposing their own tariffs on U.S. goods, making American exports more expensive — and less competitive — overseas.

- Prices are rising. Estimates suggest these tariffs could cost American households an extra $2,100 to $4,600 a year.

- Factories can’t pop up overnight. Even if demand shifted suddenly, new U.S. production would take 3–5 years to ramp up.

Bottom line? These tariffs aren’t boosting exports or domestic manufacturing — they’re just increasing costs. It’s a lose-lose proposition for families and businesses alike.

The Market’s Harsh Reaction

The response on Wall Street was swift — and brutal. On Thursday and Friday, U.S. stocks lost $6.6 trillion in value. That’s the largest two-day drop in history.

As the saying goes, “Stocks take the stairs up and the elevator down.” The ride down can be fast and painful — but it’s part of the journey.

Panic Will Not Profit

Yes, investors are panicked. And yes, we’ll likely see more selling early this week. But am I selling anything in my own portfolio? Absolutely not. Am I advising clients to “get out” of the market? Again, no.

I don’t have a crystal ball, but I do have history on my side. And if history tells us anything, it’s this:

Panic selling never works.

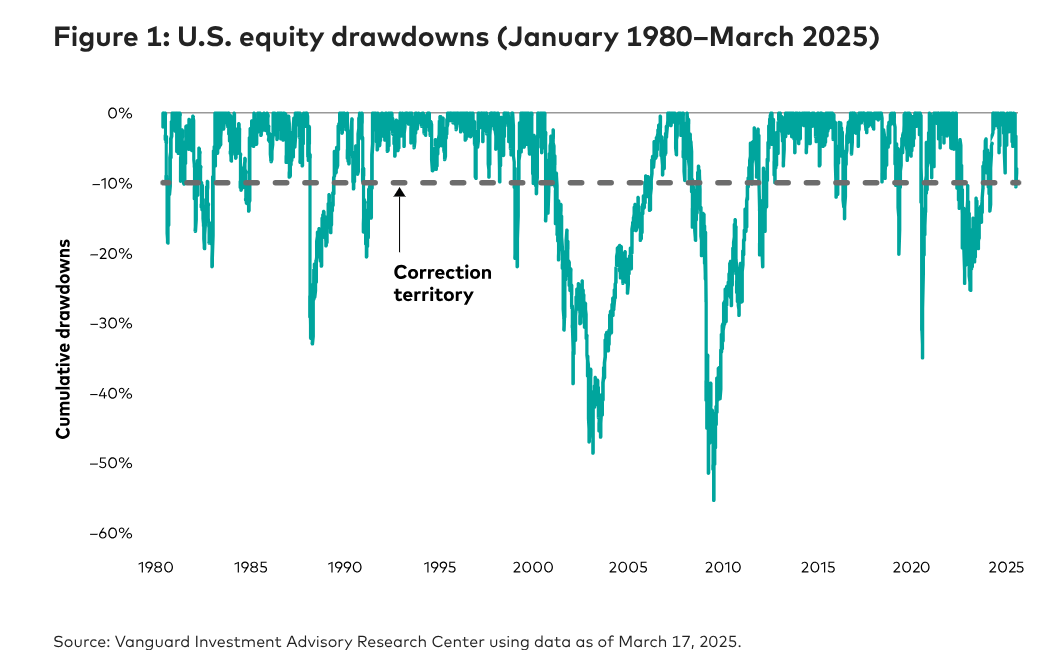

Here are some interesting charts on market corrections. First, from Vanguard, here are US Equity drawdowns since 1980.

Since 1980, the U.S. stock market has been in correction territory (down 10% or more from recent highs) about 30% of the time. Bear markets — drops of 20% or more — happen, too. And recovery can take time.

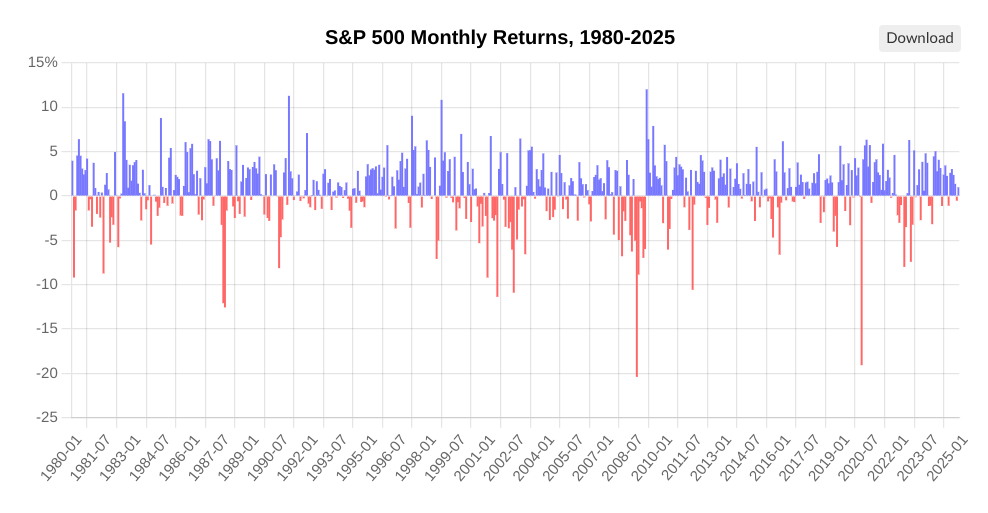

Looking at monthly returns, the next chart shows up months versus down months.

You can see that there are nearly as many down months as up months. The stock market does not go straight up nor does it go down forever. It is volatile, with good months and bad months, and good years and bad years.

These charts show the volatility of stocks, but mask the cumulative gains. In fact, since 1980, the S&P 500 has delivered a total return of 16,415%, or about 11.99% annually. That’s the big picture — and it’s why long-term investing works.

No Pain, No Gain

In 2009, I saw that investors who got out did worse than those who did nothing. The same thing happened in March of 2020. The human brain often tells us to do the wrong thing at the worst time. But real success comes from staying invested — even when it’s uncomfortable.

Trying to time the market rarely works. But owning a simple index fund and not selling? That’s the most likely way to access the 11.99% historical returns over time.

We’ve built your portfolio to withstand volatility. Most of our clients have 30% to 50% in bonds, including five-year bond ladders for retirees. That means we don’t need to sell stocks when they’re down.

What We Can Do Now

Even in market downturns, there are smart moves we can make:

- Rebalancing: When stocks are down, it’s a chance to buy — not sell.

- Tax-loss harvesting: Use losses to offset gains and reduce your tax bill.

- Dollar-cost averaging: If you’re still investing, this is your opportunity. Stocks are on sale.

We’ve been saying for a while that the market, especially tech, was overvalued and due for a pullback. Bubbles don’t pop because of valuations — they pop when an external shock happens. This tariff tantrum may have simply triggered what was already overdue.

Keep The Faith

It’s easy to focus on the negative — but don’t let fear cloud your long-term vision. Investors who panicked in 2001, 2009, and 2020 missed out on the powerful recoveries that followed.

I’m no fan of these tariffs. I hope they’re just a negotiating tactic — or that billionaires who lost hundreds of millions of dollars this week can push for a better path. But regardless of what happens next, I know this:

We’ve seen this before, and we’ve come out stronger every time.

Each investor should have a solid financial plan. That plan should account for volatility — even when it’s driven by unpredictable policy. We’re not selling based on headlines. We’re staying focused on long-term goals.

If you’re feeling uncertain or want to revisit your plan, don’t hesitate to reach out. That’s what I’m here for.

Stay steady. Stay smart. And hang in there.