Growing your net worth is the product of saving and investing. Sometimes, we assume this means we have to slash our spending to be able to save more. Sure, you want to have awareness and planning regarding your spending. But it’s not much fun to give up coffee or never take a vacation. There has to be a balance between sensible spending and your saving goals.

Luckily, there is another way to increase your savings rate: earn more. Especially for younger investors, as your income grows you will find that you can easily save more. This may take a number of years. But, as your career takes off, your income may increase at a double digit rate during your twenties and thirties.

So, don’t despair if you cannot save as much as you would like today! Focus on growing your career and increasing your income. Saving will get easier.

Hold Your Spending Steady

As you get promotions and raises, avoid the temptation to keep up with the Joneses. You will see friends and classmates who are buying fancy cars and huge houses. Good for them! But what you might not see is how much debt they have, how little they save, or their net worth. You won’t know how stressed they are about their finances. They may be two paychecks away from being broke.

Hopefully, your current lifestyle is enjoyable and you find happiness in your relationships and the things you do. Getting more expensive things is not likely to create lasting satisfaction. The temporary, but fleeting, pleasure from consumption is known as The Hedonic Treadmill. If your priority is becoming financially independent, using a raise or bonus to save more is a better choice than spending it.

Put Your Savings On Autopilot

As your income grows, save your raises. Establish recurring deposits to your retirement plans and other accounts, and increase them annually. If take this step when you receive a raise, you will not miss the extra money. Skip increasing your monthly savings, and you probably aren’t going to have extra money leftover at the end of the year. If it’s in your checking account, you will spend it!

For couples, a joint income is a tremendous opportunity. If you can live off of one salary and save the second salary, you will grow your wealth at an amazing rate. In some cases, this could literally be saving one of your paychecks. Or, it may make more sense to participate in both of your 401(k) plans, and save the equivalent of one salary.

Multiple Sources of Income

Given the economic fallout from Coronavirus, many people aren’t getting a raise this year. A lot of us are seeing that our 2020 income will be lower than 2019. Hopefully, this will be temporary, but there are lessons to be learned. It is a risk to have all your eggs in one basket with one job. If you lose that job, you’re really in trouble.

As an entrepreneur, I have always had multiple sources of income. My financial planning business is diversified across a number of clients. I also sell insurance. I make music in a couple of orchestras and teach a few lessons on the side. Some of it is small, but having multiple sources of income gives me flexibility and safety.

Have you considered finding a side hustle, second income, part-time business, or online gig? Find something you enjoy and make it into a business. Find something people need and provide that service. You never know where that part-time work might take you. Maybe someday it will allow you to retire early or be your own boss! In the mean time, use your additional income to save more and build up your investment portfolio. Don’t give up your time just for the sake of buying more things.

How and Where to Save More

How much should you save? If you are saving 15% of your income, you’re doing way better than most people in America. Start at a young age, and a 15% savings rate will likely put you in a very comfortable position by retirement age. For those who are more ambitious, or just impatient like me, aim to save more than 15%. You could be putting $19,500 into your 401(k) each year ($26,000 if over age 50).

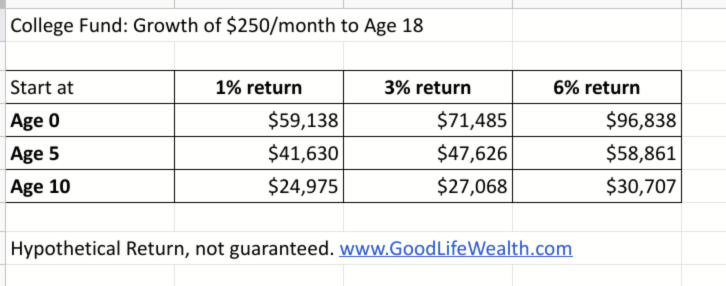

And you might be eligible for an IRA, too, depending on your income. Or, consider a taxable account, Health Savings Account (HSA), or 529 College Savings Plan. There are lots of places you could be saving! Put your savings on autopilot with recurring deposits to your retirement plans and other accounts. If take this step when you receive a raise, you will not miss the extra money, but you will be growing your wealth faster.

Do you need a reason to save more? The sooner you save, the faster you can achieve financial freedom. Even if you enjoy your work, it’s great to have the means to not have to worry about your job.

You can save more by spending less. That’s true, but you can only eliminate an expense once. Most people will have some tolerance for cutting costs, but austerity is no fun. Focus on increasing your income, hold your expenses steady, and increase your monthly savings. Put your energy into building your career, and aim for a high income. Couples have a great ability to save, if they can aim to live off one income. Look for creating a second or third income stream. A lot of the wealthy people I know have an entrepreneurial mindset. They have multiple income streams.

As your earnings grow, you will be able to save more and invest more. Most of my newsletters deal with investing, tax, or planning questions. But those benefits only accrue after you’ve done the first step of saving that money. It’s not how much you make that matters, but how much you keep!